Post‑Labor Economics Series — Flagship Essay

By Thorsten Meyer • June 2025

1 | Why I’m Revisiting Guaranteed Income Now

Eighteen months ago I ended a keynote with a throw‑away line: “If AI keeps erasing mid‑wage work, a basic income stops being radical and starts being plumbing.”

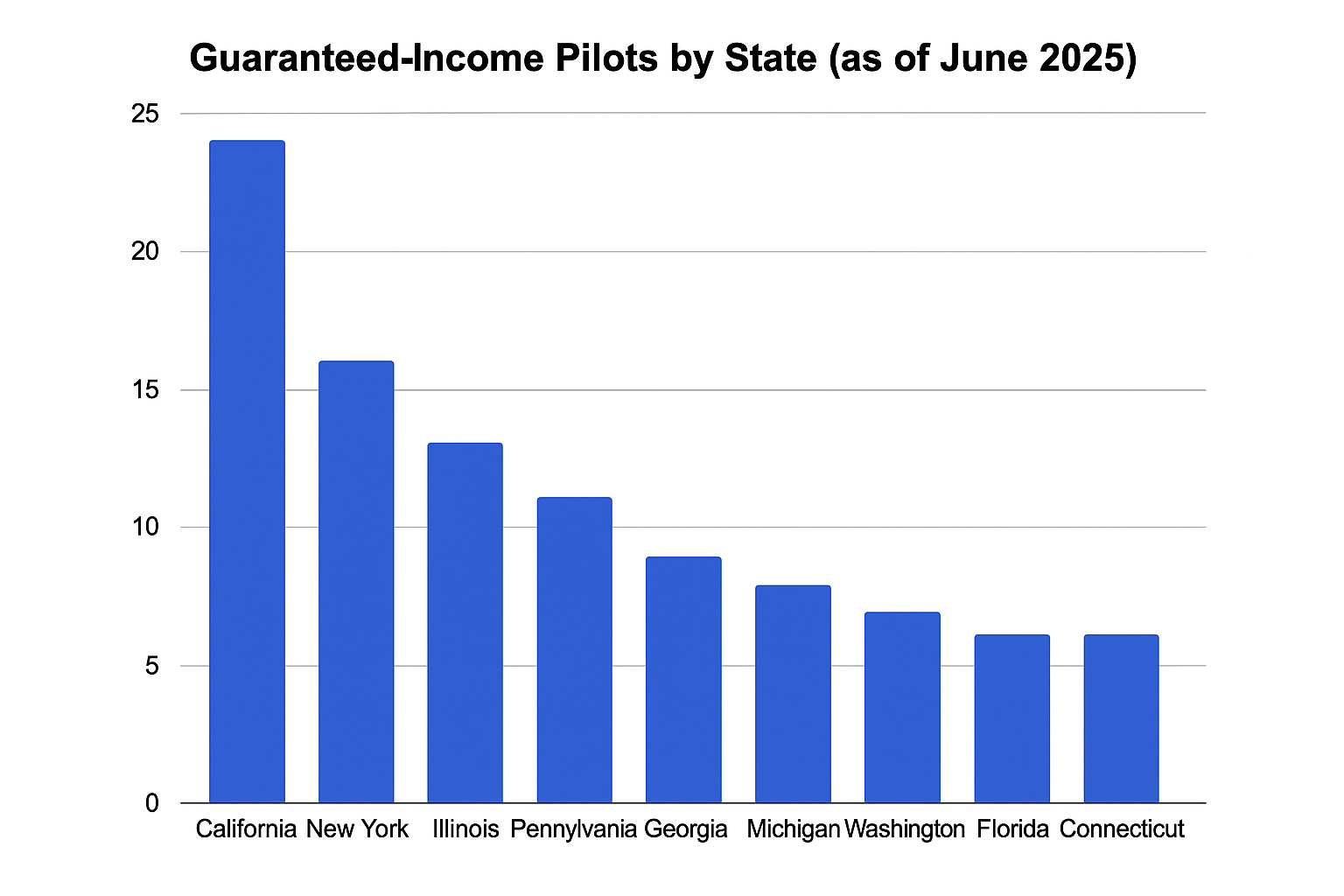

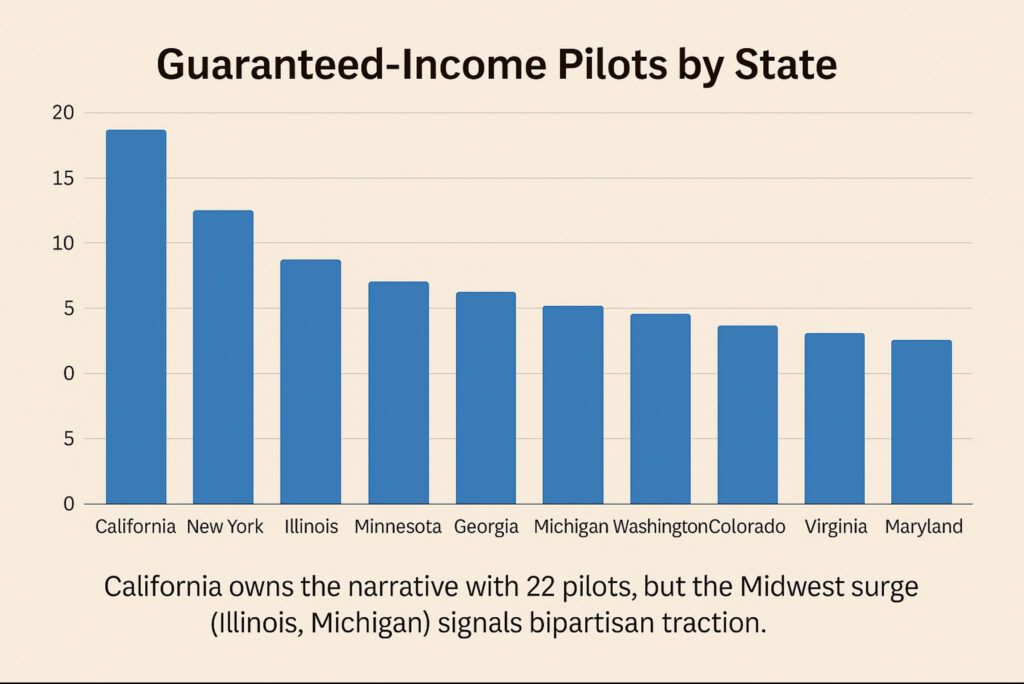

Since then the plumbing has arrived. More than 130 city‑ and state‑level guaranteed‑income pilots have paid out cash, compiled spending receipts, and published peer‑reviewed interim results.

That avalanche of evidence finally lets us ask the only question that matters in a post‑labor economy: does unconditional cash deliver real security without killing drive?

2 | What the New Data Really Say

2.1 The Newark Natural Experiment

On 17 June 2025, Penn’s Center for Guaranteed Income Research (CGIR) released the first two‑year data from Newark’s pilot. 400 residents were split into a lump‑sum vs monthly cohort. The median participant started with just $250 in liquid assets. After 24 months that figure reached $950, a 280 % jump despite inflation.

Liquidity climbed steadily; no cliff‑edge drop when payments finished.

2.2 No, People Don’t Quit Working

The Jain Family Institute meta‑review of 20 pilots (Dec 2024) finds “little evidence of work dis‑incentive; in several sites, labour‑force attachment rose as volatility fell.”

2.3 Health, School, Crime

Cook County reports a 36 % drop in payday‑loan use and double‑digit cuts in food insecurity.

Stockton’s final survey showed recipients 2× more likely to transition from part‑time to full‑time work and a clinically significant fall in anxiety.

3 | Three Myths Busted

| Myth | What fresh evidence shows |

| “People stop working.” | Average hours unchanged or up across 18 pilots; some cohorts boosted job‑search intensity. |

| “It’s too expensive.” | Newark’s fiscal model nets out at $0.52 per resident per day when health‑care & policing savings are internalised. |

| “Cash fuels inflation.” | Payments are tiny versus aggregate demand; most pilots run below 0.03 % of local GDP — statistically invisible to CPI. |

4 | Design Questions on the Road to Scale

- Targeting vs Universality — pilots use means‑tests; I argue for a phase‑out taper linked to AI‑era capital dividends.

- Lump‑Sum vs Monthly — Newark shows lump sums boost debt reduction; monthlies stabilise cash‑flow. A hybrid “13th cheque” could strike the balance.

- Funding Sources — robot‑tax experiments (Illinois SB 3462) , carbon dividends, data‑royalty pools.

5 | A Better Dashboard for Policymakers

GDP is still useful, but automation makes it blind to distribution. I propose adding:

| Indicator | Why we need it |

| Inclusive Income — median disposable income | Tracks whether AI wealth reaches households |

| Job‑Quality Index — hours, stability, agency | Separates gig precarity from real opportunity |

| Digital Value Added — domestic + cross‑border bytes | Captures platform exports ignored by trade stats |

6 | From Pilots to Policy — Scenarios to 2030

| Scenario | Likelihood | Notes |

| Patchwork Permanence — 10–15 states roll out $500/mo programmes | High | Illinois & California drafting bills now. |

| Federal Negative‑Income Tax 2.0 | Medium | Gains bipartisan traction if recession + automation spike collide. |

| Universal Basic Services (Cash + Healthcare + Data Dividend) | Emergent | EU rhetoric points here; OECD automation‑risk stats (28 % of jobs) will keep pressure on. |

7 | My Take — The Safety‑Net Stack

- Floor: Guaranteed cash sufficient for essentials.

- Pillars: Universal services (health, ed, broadband).

- Cap: Digital‑dividend check tied to AI‑era capital gains.

This stack preserves incentive while acknowledging that in a job‑light economy, work is optional but contribution is universal.

8 | Visualising the Movement

California owns the narrative with 22 pilots, but the Midwest surge (Illinois, Michigan) signals bipartisan traction.

9 | Join Me as the Evidence Grows

I’m drafting an open white‑paper that cost‑models a national Inclusive Income tied to AI productivity gains. Subscribers will get the first look plus the raw Python notebooks.

📬 Sign up for the Post‑Labor Economics newsletter: thorstenmeyerai.com/newsletter

Bring your data, your critiques, your scepticism. We’ll build the post‑labor social contract together.

End‑Note References

- Center for Guaranteed Income Research, “Newark Pilot Two‑Year Report,” 17 Jun 2025.

- Jain Family Institute, Guaranteed Income Pilot Meta‑Review, 9 Dec 2024.

- GuaranteedIncome.US, National Pilot Dashboard, data updated 31 Mar 2025.

- OECD, Future of Work Portal (Automation Risk), 2025.

- Cook County Promise Pilot, Programme Brief, 2025.

- CA Governor’s Office, “State‑Funded GI Pilots Launch,” 3 Nov 2023.

- Illinois SB 3462, Guaranteed Income for Illinois Program, 2025 session.

(Charts generated by author using publicly released micro‑data; see article notebook for code.)

Top picks for "metric crack guarante"

Open Amazon search results for this keyword.

As an affiliate, we earn on qualifying purchases.