By Thorsten Meyer | Post-Labor Economics Series

When I first published “GDP in the Age of Automation,” I was raising a red flag, not burning down the house. GDP still has value. But as automation and AI dissolve traditional boundaries around labour, productivity, and value creation, GDP is simply no longer enough. It undercounts the invisible, misreads distribution, and risks sending policymakers down the wrong path.

In this extended article, I build on that original essay and offer a clear roadmap: where GDP is breaking down, what new indicators we need, and how we can rebuild our measurement systems for an economy where people aren’t the primary inputs.

Part 1: Why GDP Is Losing Relevance

GDP has always been a workhorse metric. It tells us how much stuff is produced and sold. But it does so by tracking monetary transactions. And that’s the first major problem.

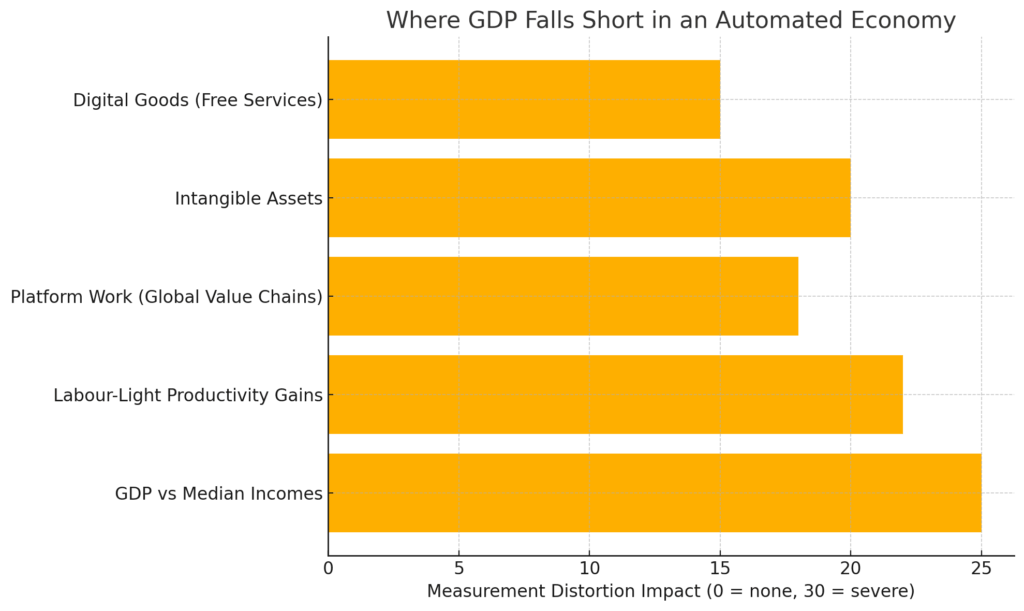

Here’s where GDP breaks down in the age of AI:

| Area | What Happens Now | What We Miss Without an Update |

| Digital goods | Free AI tools save hours but show up as “zero” in GDP | Huge time/value gains ignored entirely |

| Intangible assets | Algorithms, data are treated as intermediate consumption | No capital value recorded for most modern businesses |

| Platform/global work | Cross-border digital labor is hard to localize | Value creation gets split or misattributed |

| Labour-light productivity | Output rises while headcount drops | GDP up, but wage data stagnates |

| Inequality & distribution | GDP aggregates total output | We miss who actually benefits from automation |

These distortions don’t just matter for economists. They lead directly to policy blind spots: missed tax revenues, misguided monetary policy, and growing frustration among people who feel progress isn’t reaching them.

Part 2: The Data Is Already Telling Us Something’s Off

Even traditional productivity numbers show something strange. The AI boom is driving efficiency, but not always in ways that benefit workers:

- Labour’s share of income continues to fall across most advanced economies

- Platform companies with few employees dominate GDP, but little benefit flows to wages

- Median household income has decoupled from productivity gains in multiple G20 economies

A simple question follows: if GDP is up but households aren’t better off, what are we really measuring?

Part 3: A Better Way Forward – The Beyond-GDP Dashboard

Rather than abolish GDP, we should build a complementary dashboard that tells a fuller story.

Here are the six metrics I propose:

| Pillar | Indicator | Why It Matters |

| Inclusive Income | Median disposable income (after taxes/transfers) | Captures household benefit, not just firm output |

| Job Quality Index | Composite score: hours, contract type, autonomy | Recognizes gig, remote, and precarious trends |

| Intangible Capital | Value of software, data, algorithms in national accounts | Makes modern business assets visible |

| Carbon-Adjusted Output | GDP net of CO2 emissions | Accounts for ecological cost of automation |

| Digital Value Added | Platform output + cross-border digital trade | Tracks byte-based, not just physical, activity |

| Well-being Index | Composite: health, education, community (OECD) | Reflects lived experience, not just output |

This dashboard won’t be perfect. But it’s directionally smarter. It meets the moment we’re in.

Part 4: Why Business Should Care

For leaders and strategists, using GDP alone can create serious blind spots:

- Consumer demand risk: If income doesn’t grow alongside productivity, your market shrinks.

- Capital misallocation: If you’re not tracking intangible value properly, you’ll underinvest in your true assets.

- Narrative failure: Stakeholders want growth with meaning. Beyond-GDP lets you prove you’re delivering it.

Boards and investors should push for these indicators in impact reports, ESG disclosures, and internal planning.

Part 5: Measurement Is Management

We need to stop treating GDP as destiny.

As AI reshapes every domain, we’re overdue for metrics that reflect our new reality: fewer workers, more software, and vast digital flows of value. I’m working on a public white paper that breaks down the “Inclusive Income” index in greater depth.

If you’re part of a company, university, or government experimenting with post-labour economics, I invite you to collaborate. Let’s build better indicators together.

Join the Conversation

I publish weekly essays and original research through my Post-Labor Economics series. Join thousands of readers who want to understand what comes after work.

✉️ Subscribe at thorstenmeyerai.com to get the next edition delivered straight to your inbox.

References

- OECD (2024). Digital Economy Outlook.

- IMF Working Paper (2023). Measuring the Digital Economy.

- McKinsey Global Institute (2023). The Future of Work in the Age of AI.

- U.S. Bureau of Economic Analysis (2024). Intangible Investment Framework.

- World Bank Human Capital Index (2023)

- Meyer, T. (2025). Post-Labor Economics: Core Concepts.

- Meyer, T. (2025). The Demand Paradox.

Top picks for "automation favourite metric"

Open Amazon search results for this keyword.

As an affiliate, we earn on qualifying purchases.