Published on ThorstenMeyerAI.com

Introduction: Beyond GDP, Beyond Labor

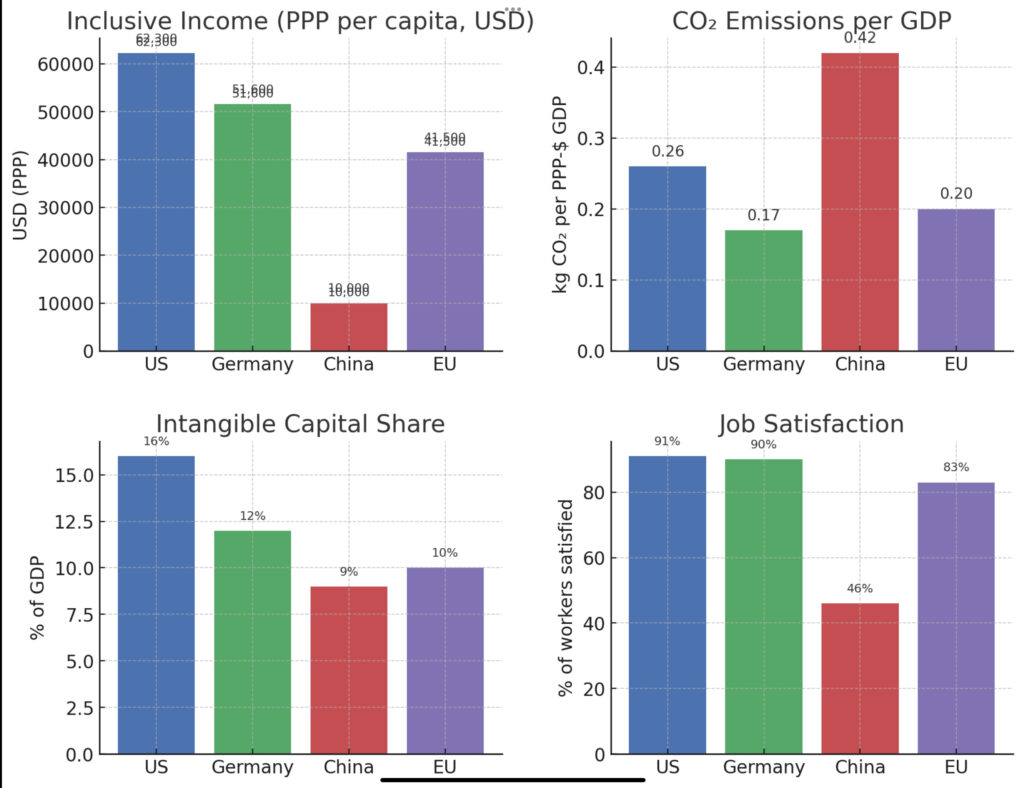

As AI and automation accelerate the decline of routine labor, our core economic assumptions must evolve. For decades, productivity, employment, and GDP served as primary indicators of prosperity. But in a world where machines perform the bulk of productive work, these indicators no longer tell the whole story. This is where Post-Labor Economics—and metrics like Inclusive Income, CO₂-Adjusted Output, Intangible Capital Share, and the Job Quality Index (JQI)—step in.

At ThorstenMeyerAI, we believe the transition to a post-labor society demands a new economic compass. This article offers a region-by-region strategic outlook across the U.S., Germany, China, and the EU, using these four forward-looking indicators to assess where we’re heading, and how leaders can steer us wisely.

The Four Metrics That Matter

- Inclusive Income

- Goes beyond GDP by measuring real, post-tax, inflation-adjusted income available to households.

- Accounts for value flows from automation, UBI, and redistributed capital income.

- CO₂-Adjusted Output

- Measures output net of environmental cost, especially carbon emissions.

- Essential to ensure automation doesn’t accelerate ecological collapse.

- Intangible Capital Share

- Captures value from software, data, patents, R&D, and organizational knowledge.

- Reflects an economy’s capacity to generate wealth independent of physical labor.

- Job Quality Index (JQI)

- Tracks not job quantity, but job dignity: autonomy, security, mental health, and upskilling potential.

Top picks for "redesign progres post"

Open Amazon search results for this keyword.

As an affiliate, we earn on qualifying purchases.

United States: The Frontier of Automation and Inequality

- Inclusive Income: Still the world’s highest average household income (~$60K PPP), but with extreme inequality. Gains from automation increasingly flow to capital holders and tech monopolies.

- CO₂-Adjusted Output: Progressing, thanks to renewable energy investments. But growth remains moderately carbon-intensive.

- Intangible Capital Share: Leads globally (~16–18% of GDP). Software, AI, and IP dominate value creation.

- JQI: Polarized. High job satisfaction in knowledge sectors; low wages, precarity, and erosion of worker protections in service sectors.

Outlook: Without redistribution and re-skilling policies, the U.S. risks a post-labor economy of hyper-wealth alongside mass underemployment.

Germany: Precision, Protection, and the 4-Day Workweek Future

- Inclusive Income: Strong and stable (~$52K PPP). High redistribution through public services.

- CO₂-Adjusted Output: Among the best globally; Germany has successfully decoupled GDP growth from emissions.

- Intangible Capital Share: Growing (~10–12%). Focused on industrial R&D, engineering, and organizational capital.

- JQI: High. Union protections, co-determination, and training programs sustain high-quality employment.

Outlook: Poised for a smooth transition. Likely to reduce workweeks rather than replace workers.

China: Scale, Speed, and Structural Tension

- Inclusive Income: Rapidly rising but still low (~$10K PPP). Gains unevenly distributed.

- CO₂-Adjusted Output: Carbon-intensive (~0.4 kg CO₂/USD GDP), but green sectors now drive over 25% of GDP growth.

- Intangible Capital Share: Climbing but inefficient. High R&D spending hasn’t yet translated into productivity parity with the West.

- JQI: Low. Precarious work and long hours dominate. Labor protections lag behind.

Outlook: Gigantic upside if it can translate intangible investments into inclusive growth. Needs new social contracts.

European Union: Decentralized Stability, Fragmented Innovation

- Inclusive Income: Mid-to-high range (~$35–45K PPP across most member states). Strong safety nets.

- CO₂-Adjusted Output: Best in class. Climate-first growth strategy paying off.

- Intangible Capital Share: Mixed. Scandinavia and Benelux strong; Eastern and Southern Europe lag.

- JQI: Generally high, though precarious contracts are rising in some regions.

Outlook: Ideal foundation for a “High-Humanity, High-Tech” economy—if innovation gaps are bridged.

Strategic Recommendations for Policymakers and Innovators

- Adopt New National Metrics: Integrate Inclusive Income and JQI into central economic dashboards. Make what matters visible.

- Incentivize CO₂-Negative Innovation: Reward firms that decouple growth from emissions. Link carbon pricing to automation gains.

- Invest in Intangibles: Focus on skills, data infrastructure, open-source ecosystems, and public R&D.

- Redesign Work: Shorten workweeks, spread access to “good jobs,” and create universal upskilling pathways.

- Recalibrate Social Contracts: Move toward Universal Basic Infrastructure (UBI 2.0): housing, mobility, education, and AI dividends.

Conclusion: A Future Worth Designing

Post-labor economics is not about the end of work. It’s about the end of work as we know it. The transition won’t be easy, but with the right frameworks, we can build economies where humans flourish because of automation, not despite it.

At ThorstenMeyerAI, we are developing these frameworks—not just to critique the old, but to prototype the next.

Let’s measure what matters. Let’s build futures worth inheriting.