By Thorsten Meyer – June 2025

Abstract

Recent productivity headlines suggest an economic revival: U.S. non-farm output per hour soared in 2024, and AI-heavy firms boast record efficiency. But for households, the gains remain stubbornly out of reach. This article dissects the disconnect between macro output and micro welfare, introduces new data from mid-2025, and proposes an original metric for measuring the true impact of AI on everyday lives.

1. The Mirage in the Averages

The U.S. Bureau of Labor Statistics reported a -1.5% productivity drop in Q1 2025 with unit labor costs jumping +6.6%. Even though hourly compensation rose 5%, real pay gained just 1.2%. This came despite widespread AI deployments in white-collar sectors. The much-hyped productivity boost is, in practice, failing to translate into tangible benefits for the average worker.

Since 2020, tech-heavy firms have delivered record earnings. OECD modeling estimates AI could add 2–3 percentage points to aggregate productivity over the next decade. But real hourly earnings have climbed only 0.9% in four years. The productivity-compensation link is broken: macro output is rising, but household purchasing power is flatlining.

2. Five Pipes Where the Gains Leak Away

| Leak | Mechanism | Evidence |

| 1. Capital-Biased Tech | Surplus accrues to owners of AI infrastructure, not labor. | Philadelphia Fed warns of a “once-in-a-lifetime decline in labor’s share.” |

| 2. Superstar Firms | Platforms with scale lock in profits; productivity doesn’t diffuse. | OECD data shows concentration in AI patents and uptake. |

| 3. Adoption Gap | Only 6.6% of U.S. firms have adopted AI meaningfully. | OECD/BCG/INSEAD 2025 survey confirms. |

| 4. Measurement Illusions | GDP overstates welfare; price deflators mask real declines. | BLS analysis shows labor share fall drives the compensation gap. |

| 5. Energy & Externalities | AI compute spikes electricity demand, driving household costs. | CBS and EPRI report 10x energy use for AI search and 20% rate hikes in some states. |

3. The Energy-Externality Trap

AI raises output, then raises the electricity bill needed to access that output. Residential utility rates have risen up to 20% in high-compute states due to surging data center demand. Worse, public health costs linked to fossil-powered AI centers now total an estimated $5.7–9.2 billion annually, often burdening lower-income areas.

Thus, even modest wage gains are eroded for bottom-quintile households whose utility bills represent 8%+ of their budgets. AI’s “productivity dividend” is eaten away before it ever lands in the bank account.

Policy idea: An AI Compute Tariff Rebate, funded by a GPU usage tax, could return value directly to impacted communities.

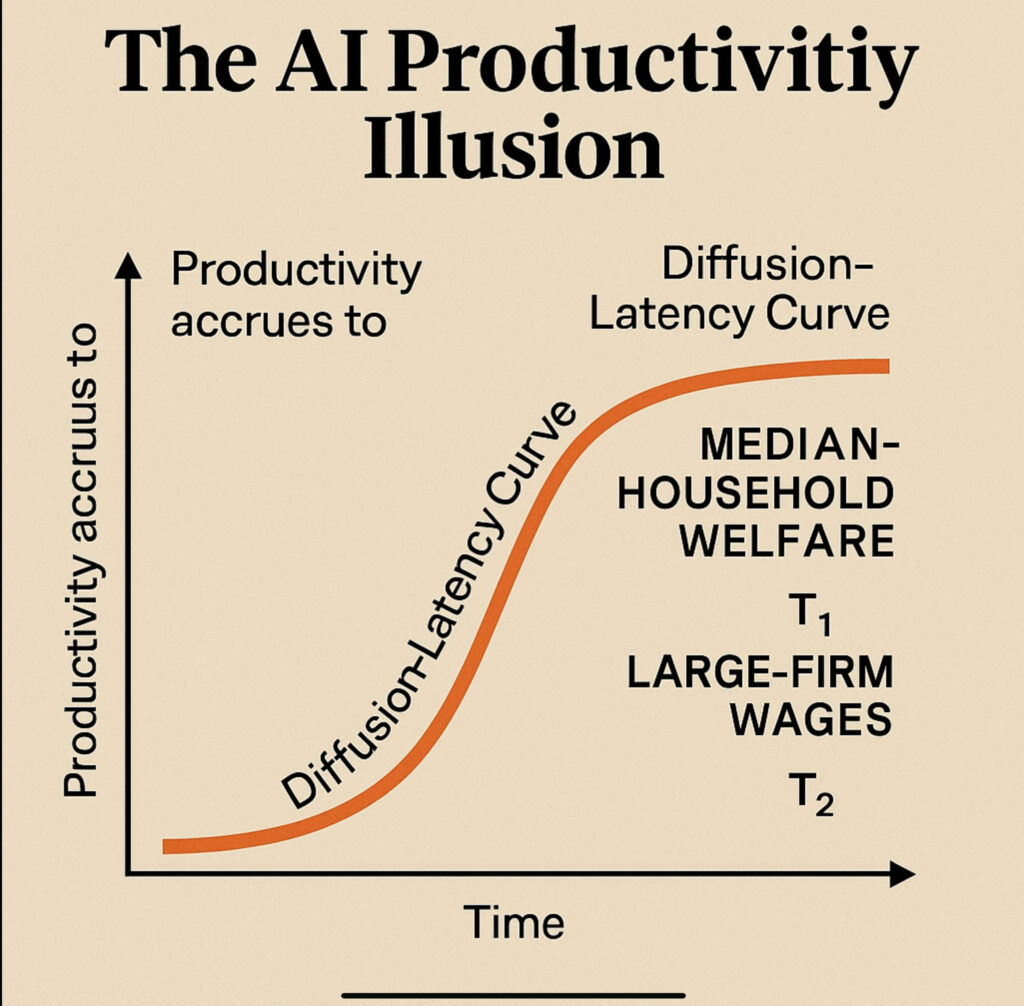

4. The Diffusion-Latency Curve

New OECD analysis suggests even with strong AI adoption, productivity gains will not reach households until the far right tail of an S-curve. Financial capital sees returns immediately; large firms benefit next; but median households are still years away from seeing gains.

With only 13.5% of EU firms and 6.6% of U.S. businesses actively using AI, the current hype cycle may be peaking far earlier than the actual economic delivery curve.

5. The Household-Level Symptoms

- Entry-Level Squeeze. 40% of employers plan AI-driven headcount reductions, disproportionately hitting junior roles.

- Gender Gaps. Women are 20 percentage points less likely to use AI tools; only 33% of AI workers are female.

- Wage Dispersion. AI-exposed occupations experience internal compression, but gaps between job classes widen. IMF finds high-AI regions had greater drops in the employment-to-population ratio.

6. Introducing the Net Household AI Dividend (NHAD)

To cut through the illusion, I propose a new metric:

NHAD = (AI productivity gains – unit labor cost inflation – energy/externality cost passthrough) / median household exposure

Early estimate for Q1 2025:

- +1.3pp productivity from AI

- –1.9pp unit labor cost inflation

- –0.4pp from energy cost passthrough

- NHAD = –1.0pp

Conclusion: Despite visible firm-level gains, the average household is falling behind.

Proposal: Publish NHAD quarterly to benchmark real-world inclusion.

7. Policy Levers: From Illusion to Inclusion

- Labor-Capital Balancing

- Windfall taxes on AI capital to fund sovereign digital funds

- Algorithmic productivity dividends negotiated via unions

- Broader Ownership

- Universal baby bond AI equity

- Data trusts managed by communities

- Accelerated Diffusion

- SME AI credit programs

- Targeted upskilling vouchers

- Recalibrated Stabilizers

- Graduated UBI indexed to local productivity gains

- Smarter Taxation

- Shift from payroll to markup and digital rents

- Reward firms that pass savings through wages or prices

8. Final Word: Connecting the Pipes

AI isn’t destined to deepen inequality. But absent structural reforms, the illusion will persist: macro charts show boom; households feel bust. The AI age doesn’t need another statistical mirage. With the right levers, we can turn productivity into prosperity, and make future GDP gains something people live, not just read about.

Top picks for "productivity illusion output"

Open Amazon search results for this keyword.

As an affiliate, we earn on qualifying purchases.