Why banks, asset managers and payments giants are hiring “conductors” to run fleets of AI agents — and how regulation is shaping the architecture.

A Sector Ripe for Orchestration

Financial‑services workflows are a perfect storm of data density, regulatory friction and latency‑sensitive decisions. Every customer interaction triggers credit rules, fraud checks, market‑data refreshes and audit logs — far more moving parts than a single copilot can juggle. That is why the industry is moving from one‑off chatbots to multi‑agent systems directed by an Agent Orchestrator. Goldman Sachs’ new firm‑wide “GS AI Assistant” already supports 10 000 staff across document analysis, code review and data queries, putting a coordinated agent layer into daily production.

What Does an Orchestrator Do in a Bank?

An Agent Orchestrator is essentially the control tower:

- Plans the graph: which agent retrieves market data, which one drafts a client note, which one signs off on policy.

- Routes the right memory and API keys to each node.

- Enforces guard‑rails (PII masking, cost ceilings, regulatory policy).

- Reflects & optimises: watches KPIs (e.g., trade‑confirmation latency) and rewrites prompts or swaps models in real time.

Frameworks such as LangGraph and CrewAI dominate pilot stacks; banks pair them with internal vector stores for data sovereignty or use hybrid SaaS control planes that keep the data plane in a VPC.

High‑Impact Use Cases & Live Examples

| Domain | Live Example | Orchestrator Outcome |

| Middle‑office automation | TIFIN AXIS runs a central orchestrator + AI agents for onboarding, trading support and reporting at RIAs and asset‑managers. | Cuts manual bottlenecks and legacy swivel‑chair work. |

| Wealth‑adviser co‑pilots | Morgan Stanley GPT‑4 bot briefs advisers before client calls (cited by Reuters alongside Citi and BofA assistants). | Advisers spend less time on prep, more on relationships. |

| Compliance & fincrime | AWS Bedrock × CrewAI blueprint orchestrates three agents (analyst, specialist, architect) to parse new AML rules and draft controls. | Turns weeks of manual rule‑mapping into overnight jobs. |

| Real‑time fraud & payments | Worldpay is accelerating AI‑agent investment to let bots both approve purchases and spot fraud on the fly. | Faster check‑out plus lower charge‑back cost. |

| Trading & research | JPMorgan’s IndexGPT suggests thematic baskets; Point72 is offering up to $400 k for AI/agent engineers to push alpha generation. |

Why Regulators Care — and How They’re Steering Design

- EU AI Act (Regulation (EU) 2024/1689): Credit‑scoring, wealth‑advice and other Annex III use‑cases are “high‑risk AI systems.” Deployers must keep risk‑management files, human‑oversight checkpoints and post‑market logs — all functions that sit naturally inside an orchestrator’s Governor and audit‑store.

- U.S. OCC: Acting Comptroller Michael Hsu warns of AI “systemic‑risk spill‑overs” and has asked academics for concrete governance research; the agency’s 2024 call for papers hints that agent explainability and kill‑switches will become supervisory expectations.

Design consequence: Every production graph now includes a Governor agent that refuses actions outside policy, plus a Decision Registry that writes chain‑of‑thought hashes to immutable storage for later audits.

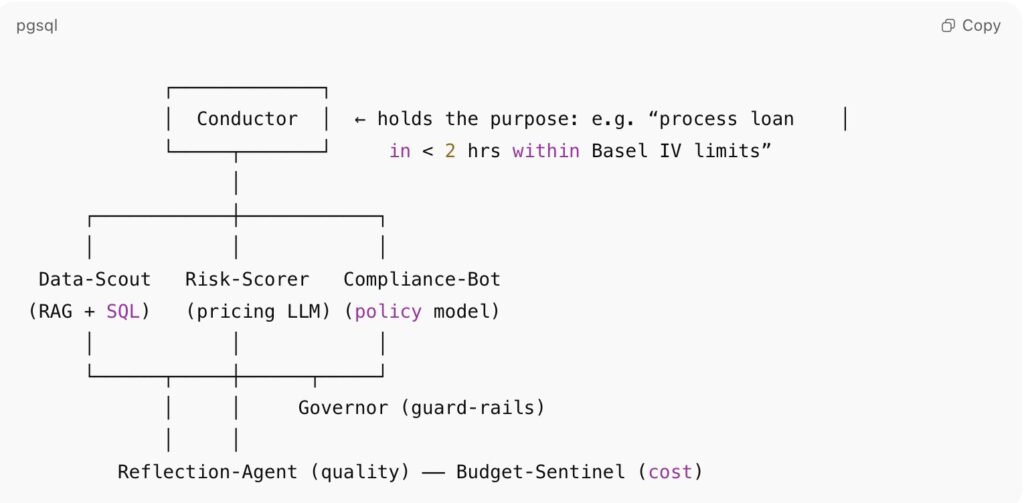

Reference Architecture for a Compliant Agent Fleet

All messages flow through a shared vector‑store; Governor checks every outbound email, API call or trade before execution.

Early KPI Benchmarks

| Metric | Result | Source |

| Compliance‑rule mapping cycle | ‑80 % (days → hours) | AWS Bedrock multi‑agent example |

| FinCrime investigation cost | ‑60 % ops spend, 40 % ↑ detection accuracy | Lucinity 2025 trends report |

| Middle‑office RIA tasks | 50 %+ task automation in first pilots | TIFIN AXIS launch |

| Employee hours saved (doc review) | 1 M+ pages / day summarised by GS AI Assistant | Goldman memo |

Talent Economics — Follow the Money

Banks and hedge funds have realised that graph thinking plus guard‑rail design is rarer than prompt writing:

- Point72 hedge‑fund advertises $400 k base for senior AI/agent engineers.

- HP lists “AI Engineer, Agentic Orchestration” with $147‑221 k range, signalling cross‑industry demand.

Expect total compensation at large banks to clear $250 k once bonus pools bundle in risk‑saving metrics.

Build vs Buy — A Financial‑Services Slant

| If Build | If Buy / SaaS |

| You need full data‑plane residency for MIFID II or OCC Part 30. | You can accept a hybrid: SaaS control‑plane + VPC execution (LangGraph Enterprise, Bedrock PrivateLink). |

| You already run Kubernetes, have 24×7 SRE and Agent Ops talent. | Speed‑to‑market < 90 days; metered node fees beat fixed GPU clusters for bursty volumes. |

| Agent IP (e.g., trading signals) is strategic secret sauce. | Compliance evidence & guard‑rail templates are bundled. |

Implementation Playbook for CIOs & CCOs

- Map a High‑Level Objective — “detect 85 % of AML alerts automatically within 2 hrs.”

- Segment Agents by Licence & Data Need — keep PII‑handling agents in the highest trust zone.

- Embed Governor + Budget‑Sentinel from Day‑1 — they’re mandatory under EU AI‑Act logging and soon‑to‑be OCC guidance.

- Stage in Synthetic Sandboxes — run adversarial prompt‑injury and goal‑conflict tests before prod.

- Instrument Reflection Loops — metrics feed RL‑based prompt tweaks without human babysitting.

- Prepare a “Conformity File” — structured docs, logs and residual‑risk statements satisfy auditors.

Bottom Line

Financial institutions are no longer asking whether to use Gen‑AI — they’re asking how to coordinate dozens of specialist models safely and profitably. Agent Orchestrators supply that missing layer, turning compliance, risk and customer ops into graph problems instead of human hand‑offs. Early adopters report double‑digit revenue lifts or cost cuts and earn regulatory goodwill by baking guard‑rails into the architecture.

In 2025, the smartest money in the room isn’t chasing the next clever prompt. It’s hiring — or becoming — the conductor who can keep an AI orchestra of quants, compliance officers and customer‑service reps playing in regulatory harmony.