(Research roundup & strategic guidance – June 2025)

1 | What “Agentic AI” Means in a B2B Context

Agentic AI refers to software entities that can plan, decide and act against a business goal with minimal human intervention. They combine large‑language models with memory, tool orchestration and real‑time feedback loops, letting them drive whole workflows instead of answering isolated prompts. McKinsey calls this the “second phase” of enterprise Gen AI, where value shifts from productivity helpers to autonomous co‑workers.

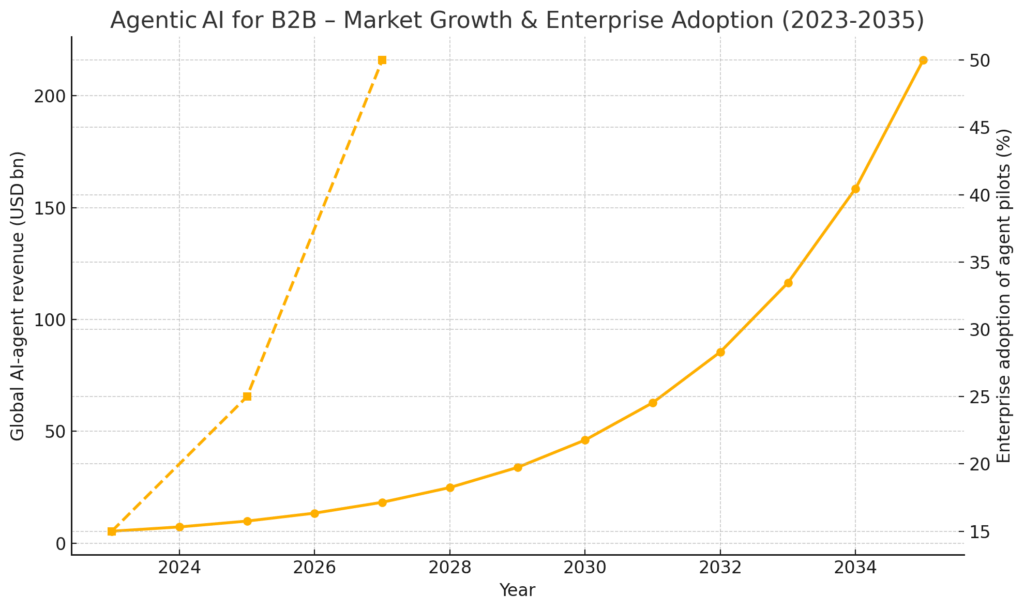

How to read the chart

- Left axis (solid circles) – Projected global revenue for agentic‑AI products grows from ≈ $5 bn in 2023 to ≈ $216 bn by 2035, reflecting ~36 % compound annual growth.

- Right axis (dashed squares) – The share of Gen‑AI‑enabled enterprises running agent pilots rises from ~15 % in 2023 to 25 % in 2025 and 50 % in 2027, signalling the mainstreaming of vertical, workflow‑native agents.

Together these curves illustrate why specialised B2B agents are the biggest near‑term opportunity: the market is scaling exponentially while enterprise adoption is crossing the early‑majority threshold.

2 | Why Specialised, Industry‑Focused Agents Are the Biggest Prize

| Force | Evidence | Implication |

| Economic upside | Global AI‑agent revenue projected to grow from $5.3 bn (2023) to $216 bn by 2035 (40 % CAGR) | Early movers can capture outsized TAM before categories mature. |

| Adoption velocity | 25 % of enterprises using Gen AI will run agent pilots in 2025, rising to 50 % by 2027 | Board‑level appetite exists; budgets are opening now. |

| Vertical ROI | Start‑ups focused on one domain (debt‑collection, recruitment, dental care, etc.) report 60–80 % cost cuts and 4–12× speed‑ups | Narrow domain depth beats broad functionality in payback and defensibility. |

| Industry concentration | 70 % of current proofs‑of‑concept cluster in banking, retail and manufacturing | Competition is fiercest here; white‑space remains in long‑tail verticals. |

| Enterprise proof‑points | KPMG’s “Workbench” already fields 50 live agents, 1 000 more in flight across tax, audit and advisory | Large incumbents are productising domain know‑how – expect fast follow‑on deals. |

3 | How to Spot a High‑Value Vertical

- Painful, repetitive knowledge work (e.g., insurance claims, clinical coding).

- Rich, proprietary data exhaust that can create an advantage the moment it’s unlocked.

- Clear success metric you can move ≥ 20 % (turn‑around time, error‑rate, dollar recovery).

- Regulatory tolerance for automation (or a compliance requirement you can simplify).

- Digital tool‑chain already in place so the agent can plug in rather than scrape screens.

4 | Hot Opportunity Zones for 2025‑26

| Vertical | Example Agent Role | Reported Outcome |

| Healthcare | Clinical‑documentation agent auto‑drafts EHR notes. | Oracle Health users cut note time 30 % |

| Supply‑Chain & Manufacturing | Autonomous planner re‑routes inventory when ports snarl. | Early pilots show cycle‑time drops of 60–90 % |

| Banking & Credit | Credit‑memo writer assembles data, drafts risk narratives. | Productivity boost 20–60 % in PoCs |

| Professional Services | Multimodal “junior consultant” synthesises research, models scenarios. | KPMG cites client‑delivery acceleration across tax & audit |

| Marketing & RevOps | Vertical agent qualifies leads, triggers campaigns inside CRM. | Salesforce execs report real‑time personalisation gains |

5 | Architecture Patterns That Win

- Domain model + tool graph. Encode business entities (e.g., policy, claim, shipment) and let the agent plan across them.

- Eval‑first pipelines. Treat eval suites like unit tests; most successful teams run them on every pull request .

- Mesh of small agents. Supervisor‑worker or panel approaches improve reasoning depth and fault isolation.

- Security as identity. Each agent gets its own credentials, access scope and a kill‑switch—security vendors are rushing MFA‑for‑agents products .

6 | Build‑Vs‑Buy Decision Grid

| Question | Build Your Own | Buy Vertical Agent |

| Data is proprietary & strategic? | ✔ | – |

| Need differentiation in customer experience? | ✔ | – |

| Regulated process with audit logs baked in? | Maybe | ✔ if vendor offers compliance toolkit |

| Speed to value critical? | – (4–6 mo. pilot) | ✔ (weeks) |

| Integration with legacy stack? | Heavy lift | Depends on vendor adapters |

7 | Execution Roadmap for B2B Leaders

- Select one gold‑line workflow (high volume × high labour cost).

- Shadow the humans: videotape clicks, decisions, edge‑cases for one week.

- Prototype agent + two automated evals in ≤ 30 days.

- Run a guarded pilot (limited data, scoped actions) under a risk‑acceptance framework.

- Measure cycle‑time, error‑rate, human‑hours saved; demand ≥ 20 % lift before scaling.

- Industrialise logging, replay and red‑teaming before broad rollout.

8 | Risks & Mitigations

| Risk | Why It Matters | Mitigation |

| Agent sprawl & shadow IT | 1 000+ “rogue” agents drain APIs, create audit gaps. | Central registry, IAM per agent, de‑dup reviews quarterly. |

| Hallucinated actions | Agents can book wrong shipment or mis‑code claims. | Rule‑based guardrails + LLM judge evals on critical steps. |

| Compliance exposure | EU AI Act treats deployer as liable for harm. | Store prompts, responses & overrides for six years. |

| User distrust | Front‑line staff bypass agent if accuracy < 90 %. | “Human‑in‑loop escalation” and visible confidence scores. |

9 | Outlook

Analyst consensus and live deployments show that vertical agents are moving from hype to hard ROI. Over the next 18 months expect:

- Procurement RFPs to ask specifically for “agent‑ready” integrations.

- Vendor M&A as SaaS incumbents buy niche‑agent start‑ups.

- A new career track—Agent Engineer—to appear on every tech job board.

B2B leaders who lock in a data advantage and an eval culture now will own the next efficiency curve; those who wait risk being leap‑frogged by AI‑native entrants.

Prepared for ThorstenMeyerAI.com – June 25 2025