You’ll see venture capital pouring into AI startups mainly in the U.S., which accounts for about 84% of the global funding, frequently through large mega-rounds exceeding $100 million. Leading investors like SoftBank, Andreessen Horowitz, and Sequoia are fueling this boom, especially in foundational and generative AI models. Sectors like customer service, legal tech, and infrastructure attract significant capital. To understand how this surge shapes the AI landscape, explore the specifics behind these high-stakes investments.

Key Takeaways

- The U.S. dominates AI funding, accounting for about 84% of global investments in Q2 2025.

- Mega-rounds over $100M, mainly in foundational AI platforms, constitute 70% of U.S. investments.

- Leading venture capital firms like Andreessen Horowitz, Sequoia, and Tiger Global are major investors.

- Generative AI models, such as GPT variants, attracted nearly $34B, reflecting strong interest in AI development.

- Infrastructure and vertical-specific AI solutions in sectors like legal and customer service are also major focus areas.

Top picks for "investment boom venture"

Open Amazon search results for this keyword.

As an affiliate, we earn on qualifying purchases.

Global Investment Trends and Record-Breaking Quarters

The momentum in AI investments continues to break records, with Q2 2025 marking the third consecutive quarter surpassing $40 billion in funding and reaching $47.3 billion. You can see that global AI funding in H1 2025 totaled $116.1 billion, already exceeding the full-year 2024’s $104.7 billion. This trend shows sustained investor confidence and aggressive capital deployment. Deal volume also increased, with 2,772 transactions in 2025—up 2.5% in Q2 alone. AI startups attracted $89.4 billion in venture capital, representing 34% of all VC investment. Generative AI attracted $33.9 billion, an 18.7% rise from 2023. These figures highlight a clear pattern of record-breaking quarters and growing investor enthusiasm across the AI landscape. Additionally, the integration of sound healing science principles into AI-driven wellness solutions is emerging as a new frontier for innovation.

Leading Regions and Major Dealmakers in AI Funding

Major AI funding activity remains centered in the United States, which captured approximately 84% of global investments in Q2 2025, totaling around $39.7 billion. You’ll find that U.S. dealmakers dominate both deal volume and value, with 728 deals in Q2 and a handful of top venture capital funds responsible for about one-third of all investment, considerably increasing from late 2024. Leading regional players include giants like OpenAI, which secured $40 billion from SoftBank, and other major rounds involving Sierra ($350M) and Blue J ($122M). Major dealmakers such as Andreessen Horowitz, Sequoia, and Tiger Global continue to lead the way, fueling the AI boom. Outside the U.S., China and Canada also see notable activity, but the U.S. remains the primary hub for large-scale AI investments.

Size and Scale of Funding: Megarounds and Large Rounds

Megarounds of $100 million or more have become the dominant form of AI startup funding in 2025, accounting for 70% of all U.S. investments and totaling approximately $157 billion across over 300 rounds. These large financings reflect investors’ confidence in transformative AI projects. Here’s what you should know:

- OpenAI’s $40 billion deal with SoftBank alone makes up about a quarter of all $100M+ rounds.

- Global VC investment in Q3 2025 surged to $120 billion, with many large raises for AI platforms.

- Median VC investment sits at $9.5 million, but large rounds skew the total funding landscape.

- The concentration of funding in mega-rounds indicates a market focused on high-impact, high-value startups.

- The trend towards mega-rounds underscores the increasing importance of funding size in shaping AI’s future landscape.

This trend highlights the growing importance of big-ticket investments in AI’s future.

Investor Profiles and Funding Sources in the AI Ecosystem

Investors fueling the AI boom come from diverse backgrounds, each bringing unique motivations and investment strategies. Venture capital funds lead the charge, making up 34% of all AI investors in H1 2025, often targeting high-growth startups with disruptive potential. Private equity and asset managers, comprising 13%, tend to invest larger sums, focusing on more mature companies or infrastructure plays. Corporate venture arms, representing about 8.5%, prioritize strategic alignment, often acquiring startups to access talent and technology. Incubators, accelerators, and angels account for roughly 10%, typically investing smaller amounts to nurture early-stage innovation. You’ll find angel investors median at $4.8 million per round, while institutional players often engage in megabonds of $100 million or more. This mix drives the rapid scaling and diversification of AI investments worldwide.

Sector Focus and Emerging Use Cases Driving Investment

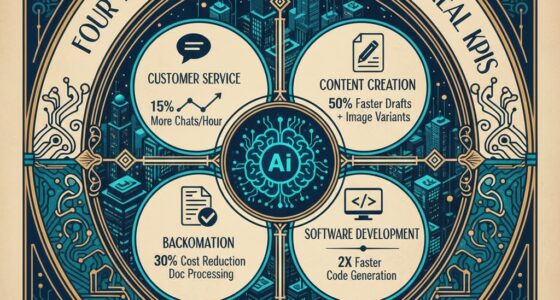

The focus of funding in the AI sector has shifted toward foundational models, platforms, and infrastructure that enable a wide range of applications. You’re seeing investors backing core tech that powers diverse solutions. Here’s what’s driving this trend:

- Large-scale foundational AI models, like GPT variants, attracting hefty investments, especially in generative AI.

- Vertical solutions targeting specific industries, such as customer service (Sierra) and legal research (Blue J), gaining significant capital.

- Infrastructure platforms supporting AI deployment, including data centers and cloud-based tools, securing large funding rounds.

- Talent acquisition tools driven by AI, as firms seek to modernize operations and compete for skilled teams.

- The development of eco-friendly and sustainable AI technologies, as investors seek to support environmentally responsible innovations.

These areas are shaping the market, fueling innovation, and promising transformative impacts across sectors.

Frequently Asked Questions

How Has AI Funding Impacted Startup Valuations Globally?

You’ll notice that AI funding has substantially driven up startup valuations worldwide. As investors pour more capital into AI startups, especially megafunds and large rounds, valuations soar. This influx of cash fuels high growth expectations, leading to inflated valuation multiples. You’ll also see that big deals and strategic acquisitions push valuations even higher, creating a competitive environment where startups are valued more aggressively than ever before.

What Are the Key Challenges Facing AI Startups Attracting Funding?

You face several challenges attracting funding, including market volatility and high growth costs. Investors seek big megarounds, but competition for top talent is fierce, driving up salaries and acquisition costs. Additionally, startups often need extensive capital to prove their models, which can deter early-stage funding. Balancing rapid growth with sustainable operations remains tough, and steering macroeconomic uncertainties adds further risk, making it harder to secure consistent investor confidence.

Which Emerging AI Sectors Are Expected to See Increased Investment?

You can expect increased investment in foundational AI models, platforms, and infrastructure as they attract the largest funding rounds globally. Vertical AI solutions in customer service, legal research, and data center development are also gaining momentum, driven by their practical applications. Generative AI continues to draw strong private investment, reflecting its transformative potential. As funding concentrates, these sectors are poised for significant growth, especially with corporate M&A activity fueling innovation.

How Do Geopolitical Factors Influence AI Investment Distribution?

Imagine a chessboard, where each move shaped by geopolitics shifts the balance of power. Geopolitical factors act like invisible hands, steering AI investment toward friendly regions and away from contested areas. You see this in the U.S. dominating with 84% of funding, while China, Europe, and Canada carve out their own territories. These dynamics influence where venture capital flows, creating a landscape of strategic alliances and rivalries that shape AI’s future.

What Role Do Corporate Ventures Play in Shaping AI Funding Trends?

You see corporate ventures play a vital role in shaping AI funding trends by making sizable investments, often through corporate venture capital arms that account for about 8.5% of all AI investors. They fund foundational models, platforms, and vertical solutions, often leading large deals and megaround funding. Their strategic acquisitions of startups also help access talent and technology, fueling innovation and maintaining competitive advantages in the evolving AI landscape.

Conclusion

As you follow the AI investment surge, it’s striking that over $30 billion was poured into AI startups just last quarter. This massive influx shows no signs of slowing, with venture capitalists increasingly betting on AI’s transformative potential. If you’re looking to understand where the next big breakthroughs might come from, keep an eye on these booming sectors and major dealmakers shaping the future of AI innovation.