Executive summary

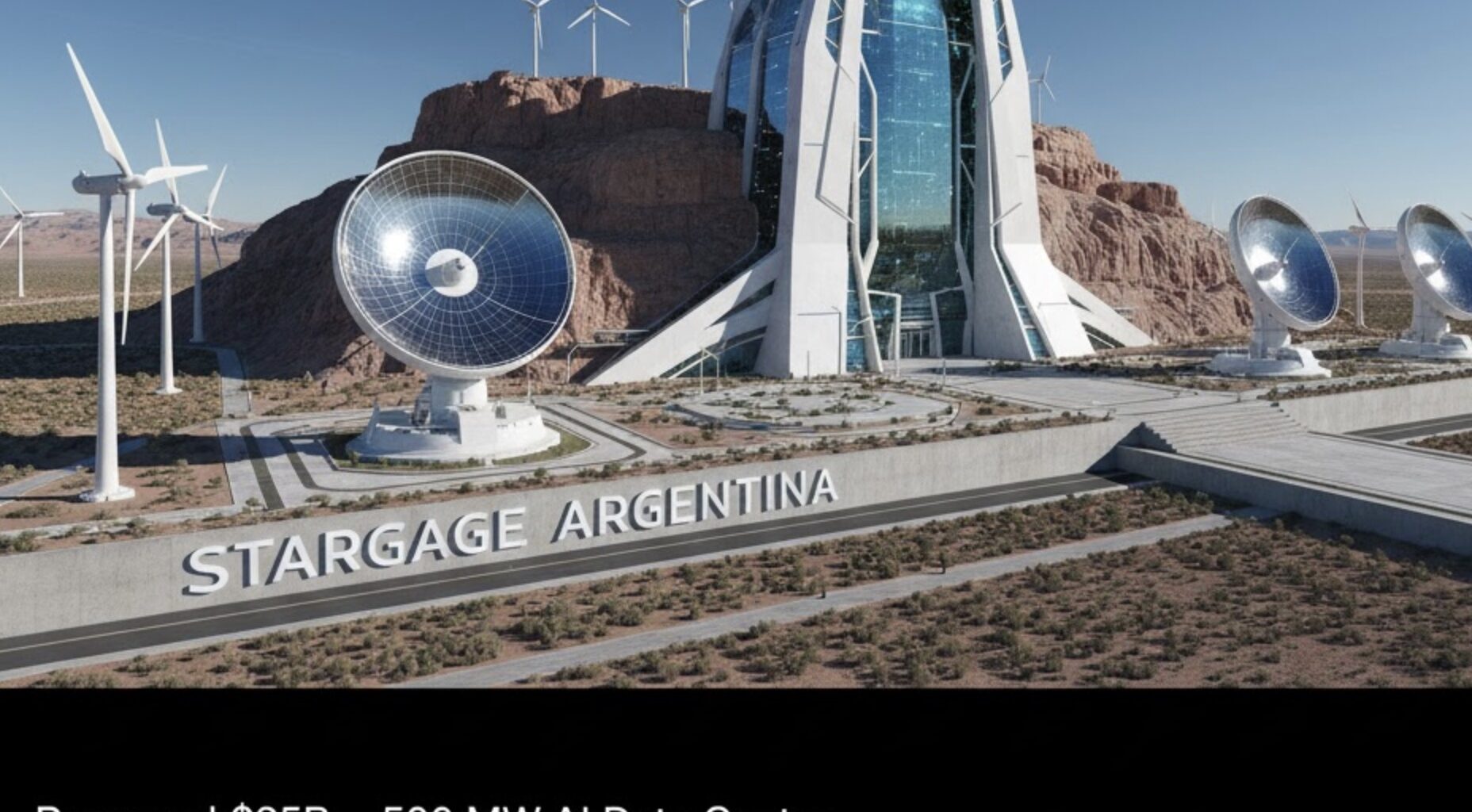

OpenAI and Argentina-based Sur Energy signed a letter of intent (LOI) to explore a data center project of up to $25 billion in Argentina’s Patagonia region. The facility is pitched at up to ~500 MW of IT capacity and would be structured under RIGI (Argentina’s Incentive Regime for Large Investments), a 2024-25 legal framework offering long-term tax, customs and FX stability for mega-projects. If realized, it would be one of the largest technology and energy infrastructure builds in Argentina’s history and OpenAI’s first “Stargate”-class project in Latin America. Reuters+2Buenos Aires Herald+2

Top picks for "argentina openai energy"

Open Amazon search results for this keyword.

As an affiliate, we earn on qualifying purchases.

1) Parties, deal status, and what the LOI means

- OpenAI: Seeks hyperscale compute growth and geographic diversification for frontier model training/inference. Publicly framed this as the first Stargate project in Latin America. LOI stage implies non-binding intent while diligence is performed on siting, interconnection, permitting, water, and power offtake. Reuters

- Sur Energy: Argentine-U.S. affiliated developer focused on power for compute campuses, partnering with OpenAI to scope location, energy, and delivery model. (Government and local reporting identify Sur Energy as OpenAI’s key local partner.) Buenos Aires Herald

- Government of Argentina: Announced the LOI and emphasized use of RIGI to attract large-scale FDI. Policy priority: anchor-tenant digital infrastructure aligned with energy build-out. Reuters

Implication: At LOI, the project is not yet financed or permitted. Timelines, technology mix, and final capacity remain subject to feasibility, policy durability, and market conditions. (This is typical for multi-billion-dollar hyperscale builds.)

2) RIGI: the incentive framework

- What it is: A national regime for large investments enacted in 2024 as part of a major reform package (“Bases Law”), designed to grant long-term tax, customs, and FX stability plus legal certainty to projects above set thresholds (generally ≥ US$200 m). Sectoral definitions and rules were further implemented by decree in 2024–25. PwC+2EY+2

- Why it matters here: Data center and energy assets are capital-intensive with long paybacks. RIGI’s stability and potential tax/withholding benefits and currency-convertibility assurances can materially improve bankability and reduce country-risk premia for lenders and equity. PwC+1

3) Location thesis: Why Patagonia?

Power resource & climate: Patagonia offers world-class wind capacity factors and cool ambient temperatures (favorable for free-air/evaporative cooling). Proximity to large-scale renewables lowers operating carbon and can stabilize long-run electricity costs—both vital for AI training clusters. (Government and local press have referenced Patagonia as the intended region.) Buenos Aires Herald

Risks to manage:

- Transmission from renewable basins to site (or co-location with generation);

- Grid stability and potential need for on-site firming (gas peakers, battery energy storage, or long-duration storage);

- Water constraints and community sensitivities; and

- Seismic/wind engineering for campus hardening.

4) Scale and architecture: what a 500 MW AI campus entails

- Capacity: “Up to ~500 MW” likely refers to IT or critical load; total campus draw (incl. PUE overhead) could exceed that. Current AI training builds often target PUE ~1.15–1.25 with intensive liquid cooling (direct-to-chip or rear-door heat exchange) and growing interest in immersion for next-gen accelerators. Datacenter Dynamics

- Capex realism: Global benchmarks for AI-centric hyperscale suggest $12–$25 m per delivered MW depending on geography, cooling, land, grid upgrades, and on-site generation/storage. A headline “up to $25 billion” for a 500 MW class campus implies inclusion of substantial energy infrastructure (new generation, transmission, storage, water/wastewater plants) and multi-phase expansion—not just white-space shells. (This is consistent with public framing of the initiative as an energy + tech infrastructure effort.) Reuters

Potential design blocks (illustrative):

- 5–8 phases of 60–100 MW IT each, aligned with power & cooling delivery;

- Mixed cooling (direct-to-chip liquid; higher-temp loops to reduce chiller lift);

- On-site 400 kV substation, dual-feed; ≥ N+1 at campus level;

- 1–2 GW of contracted renewable nameplate (wind/solar) + firming/battery to support 24/7 CFE targets.

5) Power & sustainability strategy

Likely stack:

- Renewables PPA/portfolio anchored in Patagonian wind;

- Firming via grid, batteries, and/or gas-fired peakers for reliability during wind lulls;

- 24/7 carbon-free energy matching ambition over time (hourly matched certificates), aligning with hyperscalers’ evolving standards.

Water & cooling: Patagonia’s cooler climate helps, but water stewardship remains a critical EIA topic. Expect air-side economization + liquid loop designs with very low WUE and potential industrial water recycling.

6) Economic impact for Argentina

- Construction wave: 5–8 year multi-phase construction cycle with thousands of direct and indirect jobs across civil, electrical, mechanical, and utility build-outs.

- Supply chains: Local fabrication for steel, prefabricated modules, and electrical gear can generate multiplier effects; however, imported high-spec equipment (transformers, switchgear, chillers, IT racks, advanced liquid-cooling components) will be significant.

- FDI signal: Validates RIGI’s objective to attract large, export-oriented projects; strengthens the policy narrative of tech-led growth. PwC+1

7) Regulatory, community, and ESG considerations

- Permitting & EIA: Comprehensive environmental impact assessments (flora/fauna, water use, noise, construction traffic), indigenous/community consultation, and cultural heritage reviews will be scrutinized.

- Policy durability: Investors will evaluate the stability of RIGI across political cycles, including FX convertibility for dividends/debt service. Civil-society groups have already framed RIGI as offering extensive corporate privileges; expect debate around distributional impacts and environmental safeguards. Transnational Institute

- Grid integrity: Coordination with ENRE/CAMMESA (national regulators/system operator) for interconnection and curtailment rules; potential public investment in transmission spurs.

8) Delivery models & financing contours (what to watch)

- Campus SPV + energy SPVs: Separate vehicles for the data center real assets and power assets (renewables, storage, peakers) to optimize cap tables and risk allocation.

- Incentive stacking: RIGI + any provincial/municipal tax abatements, customs relief for imported IT gear, and accelerated depreciation. PwC+1

- Debt/equity mix: Multilateral or ECA participation could reduce cost of capital; green or sustainability-linked tranches aligned to 24/7 CFE and water targets.

- Cloud partners: Reporting mentions an unnamed cloud infrastructure provider; a co-tenant or JV cloud anchor would de-risk utilization and network backhaul. (Press has hinted at such involvement.) Business Insider

9) Risk matrix (abridged)

| Risk | Vector | Mitigation (examples) |

|---|---|---|

| Policy/FX | Changes to RIGI, capital controls, convertibility | RIGI stability clauses; offshore escrow; multilateral guarantees; revenue hedging. PwC+1 |

| Grid & power | Transmission delays; renewable intermittency | Phased interconnect; on-site firming; diversified PPAs; battery storage. |

| Supply chain | Long lead times (transformers, GPUs) | Early binding orders; modular build; diversified vendors. |

| Social license | Local opposition, land & water concerns | Early consultation; local jobs & training; low-WUE design; transparent monitoring. |

| Cost inflation | EPC, equipment & logistics | Framework agreements; index-linked contingencies; design-to-cost. |

| Technology churn | Cooling & rack density shifts | Flexible whitespace; high-temp liquid loops; immersion-ready aisles. |

10) Milestones & realistic timeline (indicative)

- 2025–2026: Feasibility, grid studies, site control, baseline EIAs, anchor PPAs, initial permits.

- 2026–2027: Phase-1 FID if bankability thresholds met; start of transmission works and campus civils.

- 2027–2028: First 60–100 MW IT online (pilot blocks).

- 2028–2031: Multi-phase ramp toward several hundred MW, contingent on power delivery and supply chains.

(These phases are typical for projects of this scale; actual dates depend on permitting and delivery of power/IT equipment.)

11) How this compares globally

- Scale: A 500 MW target places “Stargate Argentina” among the largest AI-purpose campuses announced globally. Few sites combine abundant new-build renewables with cool climates and RIGI-level fiscal/FX stability instruments. Datacenter Dynamics

- Cost frame: The “up to $25 billion” headline suggests a campus + energy system package rather than data halls alone—consistent with frontier-AI sites that internalize reliable, low-carbon power at scale. Reuters

12) What to watch next

- Publication of site specifics (municipality, land footprint). Buenos Aires Herald

- Transmission plan and any new high-voltage lines or substations supporting the campus.

- Water sourcing (municipal vs. industrial reuse), WUE targets, and cooling technology choices.

- Energy mix: PPA announcements (wind/solar), any gas-peaker tenders, and battery storage size.

- RIGI rulings/decrees specific to digital infrastructure; any litigation or political challenges. EY

- Identification of the cloud/hyperscale partner cited in media reports. Business Insider