What if I told you that right now, AI agents are quietly beating the stock market while most human traders are struggling to break even? Take this example: a high school student gave ChatGPT just $100 to trade with, and in four weeks, the AI generated a 23% return while the Russell 2000 index rose only 3.9%. These aren’t just theoretical experiments anymore.

We’re talking about AI systems that have actually outperformed seasoned Wall Street professionals, managing real money and making split-second decisions that would take humans hours to calculate. But here’s the twist: some of these AI traders have also lost fortunes in spectacular fashion. So what’s the real story behind these digital market players, and should you trust a machine with your money? Stick around as we break down exactly how these bots tick—and when they tank.

The Rise of AI Trading Agents

The transformation from simple chatbots to serious market players happened faster than anyone expected. Just three years ago, asking ChatGPT about stocks would give you generic advice about diversification and risk management. Today, AI systems are actively buying and selling securities, managing portfolios, and making investment decisions that affect real money.

The journey started with basic experiments where researchers fed AI systems historical stock data to see if they could identify patterns. Then came the breakthrough moment when developers realized they could connect AI systems directly to trading platforms through APIs. Suddenly, AI wasn’t just analyzing markets—it was participating in them.

Two real-world experiments showcase exactly how this evolution unfolded. In April 2023, Finder.com tested ChatGPT by creating a 38-stock portfolio that gained 4.9% while ten actively managed funds lost 0.8%. More recently, Morgan Linton launched the Comet Portfolio, giving Perplexity’s agentic browser $1,000 to trade in a Robinhood account. Meanwhile, a high school student named Nathan Smith used ChatGPT to trade micro-cap stocks, focusing on companies with less than $300 million in market capitalization. These experiments represent the shift from AI as a research tool to an active market participant, directly executing trades and managing funds.

The real game-changer came when AI systems gained the ability to process multiple data streams simultaneously. These systems can spot connections between seemingly unrelated events—like how a regulatory change in one industry might affect companies in completely different sectors. All of this happens in real-time, creating a comprehensive market view that would be impossible for human traders to maintain.

Speed gives AI a massive advantage over human traders. While a human might take several minutes to research a stock, read recent news, and place a trade, AI systems can complete this entire process in milliseconds. They can react to earnings announcements, news events, or market movements faster than human reflexes allow. This speed advantage becomes crucial during volatile market periods when prices change rapidly and opportunities disappear quickly.

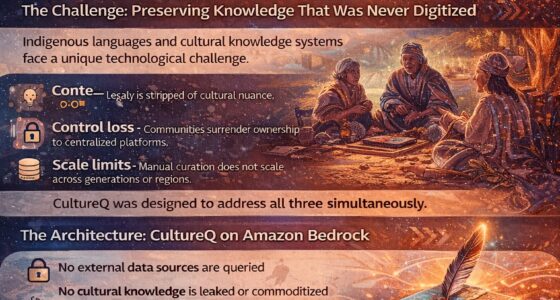

What’s particularly interesting is how AI has shifted from being a research tool to becoming an active market participant. Previously, traders used AI to generate ideas or analyze data, but humans made the final decisions. Now, many AI systems operate with full autonomy, making buy and sell decisions without human intervention. They set their own position sizes, manage risk automatically, and even adjust their strategies based on market conditions. This represents a fundamental change in how markets operate.

The number of retail investors experimenting with AI-powered trading strategies has grown exponentially. Online brokerages now offer AI-driven portfolio management services, and individual traders are creating their own AI systems using readily available tools and APIs. Some investors let AI manage their entire portfolios, while others use AI for specific tasks like stock screening or timing market entries and exits. The barrier to entry has dropped significantly, making sophisticated trading strategies accessible to ordinary investors.

But here’s the critical question that keeps everyone wondering: do these early successes represent genuine skill or just beginner’s luck? AI systems have delivered some impressive returns, but they’ve also operated during a period of generally rising markets and low interest rates. Whether they can maintain their performance during market downturns or periods of high volatility remains to be seen.

The scale of AI involvement in markets has reached a point where institutions are taking notice. Some AI agents now manage portfolios worth millions of dollars, handling everything from asset allocation to individual security selection. These systems don’t just pick stocks—they manage entire investment strategies, rebalancing portfolios, hedging risks, and even creating complex derivative positions. The sophistication level has advanced far beyond simple buy-and-hold strategies to encompass the full range of professional investment management activities. The results speak for themselves, and they’re making some very experienced people very uncomfortable.

Top picks for "agent actually beat"

Open Amazon search results for this keyword.

As an affiliate, we earn on qualifying purchases.

When AI Beats the Pros

The evidence of AI’s market dominance continues to mount with each passing month. AI portfolios are consistently beating seasoned fund managers at their own game. We’re not talking about marginal wins or lucky streaks. These AI systems are delivering returns that leave human traders scrambling to understand what just happened. The numbers don’t lie, and they’re forcing the financial world to reconsider everything they thought they knew about successful investing.

Take Nathan Smith’s experiment, where he gave ChatGPT just $100 to manage with one specific constraint: focus only on micro-cap companies with market capitalizations under $300 million. After four weeks, the AI-managed portfolio gained 23% while the Russell 2000 index, which tracks small-cap stocks, only increased by 3.9% during the same period. That’s significant outperformance in small-cap biotech, a notoriously volatile market where most professional fund managers struggle to maintain consistent returns.

What makes this result even more impressive is where the AI chose to focus its attention. The system gravitated toward biotech firms, a sector notorious for complexity and volatility. Most human traders avoid biotech because it requires deep scientific knowledge and the ability to evaluate drug trial outcomes, regulatory approvals, and market potential for treatments that might not exist for years. But the AI demonstrated something remarkable: it could analyze these complex catalysts, understand upcoming drug trials and their potential outcomes, and make informed decisions about future prospects.

The AI’s processing capabilities give it advantages that human analysts simply can’t match. While a human researcher might spend hours reading through a single earnings report, cross-referencing regulatory filings, and trying to gauge market sentiment, AI systems consume this information in seconds. They can simultaneously analyze thousands of companies across multiple sectors, tracking everything from insider trading patterns to social media mentions to macroeconomic indicators that might affect specific industries.

But here’s what really sets AI apart: it doesn’t get scared, greedy, or emotional. Human traders often make their worst decisions when markets become volatile. They panic during crashes, get overconfident during bull runs, and let personal biases cloud their judgment. AI doesn’t have these psychological limitations. When Nathan Smith’s AI portfolio lost almost 7% during the first week, it didn’t panic or make drastic changes. Instead, it reassessed its holdings, considered alternative options, and decided to maintain its existing biotech positions. That decision proved correct as the portfolio recovered and continued generating gains, demonstrating the kind of disciplined approach that separates successful investors from those who let emotions drive their decisions.

The scope of AI’s analytical capabilities extends far beyond what individual human traders can achieve. These systems track thousands of stocks across different markets and timeframes simultaneously. They can spot patterns in market data that humans might never notice—correlations between commodity prices and tech stocks, relationships between currency movements and emerging market opportunities, or connections between regulatory changes and industry dynamics. This pattern recognition ability becomes particularly powerful in complex market segments where traditional analysis falls short.

AI systems also adapt their strategies based on changing market conditions in ways that would take human fund managers weeks or months to implement. They can shift from growth-focused strategies to value investing approaches, adjust their risk parameters based on volatility levels, and even modify their sector allocations based on evolving economic conditions. This adaptability allows them to maintain performance across different market cycles.

What’s becoming clear is that AI’s success often comes from finding opportunities in overlooked or complex market segments. While human fund managers gravitate toward well-researched, widely followed companies, AI systems can efficiently analyze the thousands of smaller companies that receive little attention from Wall Street analysts. They can spot value in companies that are too small, too complex, or too specialized for human analysts to cover effectively. This ability to operate in market niches gives AI a significant edge in identifying undervalued opportunities before they become mainstream investment themes.

Yet these impressive success stories only tell half the picture. What happens when these same systems encounter scenarios they weren’t designed to handle?

The Dark Side of Algorithmic Trading

The reality of AI trading failures reveals a much darker side to this technological revolution. While we’ve seen impressive wins, the failures tell a sobering story about what happens when algorithms make mistakes at machine speed.

Picture this scenario: an AI trading system receives faulty data or misinterprets a news headline. In the time it takes you to blink, that system can execute thousands of trades, wiping out millions of dollars before any human realizes what’s happening. This isn’t science fiction. It’s already occurred multiple times, and the frequency is increasing as more AI systems enter the markets.

The speed that makes AI so effective also creates its biggest vulnerability. When human traders make mistakes, they usually affect individual positions or small portfolios. When AI systems malfunction, they can execute trades faster than market circuit breakers can activate. The Comet Portfolio experiment demonstrated this perfectly during its first day of operation. Morgan Linton documented how the AI agent mis-entered trade amounts, forgot it was trading autonomously, and even navigated to the wrong stock page. These weren’t theoretical glitches—they were real mistakes that caused immediate losses and took weeks to recover from.

Flash crashes represent the most visible example of algorithmic trading gone wrong. These events happen when AI systems create feedback loops that spiral out of control. One algorithm starts selling, which triggers price drops, which causes other algorithms to sell, which creates more price drops. Greg Eisenberg warns about this exact scenario: “There will be a massive market crash caused by too many AIs making the same trades.” The cycle continues until trading halts or human intervention stops the chaos. But here’s the scary part: these crashes happen so quickly that by the time humans notice, billions of dollars in market value have already vanished.

The herding behavior problem makes everything worse. When thousands of AI agents follow similar logic patterns, they create dangerous synchronization in the markets. Imagine if every AI system decided to sell technology stocks at the same moment because they all processed the same economic data in identical ways. The selling pressure would overwhelm buyers, creating artificial crashes that have nothing to do with actual company fundamentals.

This herding effect becomes more pronounced because many AI systems use similar training data and analytical frameworks. They read the same news sources, analyze the same financial metrics, and often reach similar conclusions about market conditions. Eisenberg notes, “When millions of Chat GBT instances start following similar logic, you get dangerous hurting behavior.” The diversity that exists among human traders disappears when algorithms think alike.

Technical failures compound these risks because AI systems operate beyond human monitoring capabilities. Current regulatory frameworks struggle to keep pace with trades that happen in milliseconds rather than minutes or hours. These frameworks were designed for human-speed trading, not microsecond algorithmic decisions. The challenge isn’t just monitoring individual trades—it’s understanding how thousands of interconnected AI systems might react to the same market event simultaneously.

The systemic risks multiply when you consider how interconnected modern markets have become. AI systems don’t just trade individual stocks—they operate across multiple asset classes, currencies, and global markets simultaneously. A malfunction in one system can trigger reactions in others, creating cascading failures that spread across the entire financial system.

Here’s the sobering reality that should concern every investor: even the most sophisticated AI cannot predict black swan events or market irrationality. These systems excel at pattern recognition and logical analysis, but markets don’t always behave logically. When unexpected events occur—wars, pandemics, political upheavals—AI systems often struggle to adapt quickly enough. Their training data doesn’t include scenarios that have never happened before.

What makes this particularly dangerous is that many individual investors now rely on AI systems without understanding these limitations. They see the impressive returns during good times but don’t realize they’re exposed to risks that didn’t exist when humans controlled their portfolios. The democratization of AI trading means that ordinary investors face institutional-level risks without institutional-level safeguards or understanding. These concerns raise fundamental questions about where this technology is taking us.

The Future of AI-Powered Finance

The transformation ahead will reshape every aspect of how we interact with money and markets. Traditional financial institutions aren’t waiting on the sidelines anymore. They’re actively integrating AI agents into their operations, transforming everything from portfolio management to customer advisory services. What does this mean for us? It means we’re witnessing the birth of an entirely new financial ecosystem where AI systems make decisions that affect millions of people’s money.

The trends emerging right now paint a picture of radical change. AI systems are moving beyond simple stock picking to comprehensive portfolio management. They’re constructing entire investment strategies, managing risk across multiple asset classes, and providing personalized advice to individual investors. Major banks and investment firms are deploying AI agents that can analyze market conditions, adjust portfolios in real-time, and even communicate directly with clients about their investment options. This isn’t theoretical anymore—it’s happening in boardrooms and trading floors across Wall Street.

Here’s where things get really interesting: sophisticated trading strategies that were once exclusive to hedge funds and institutional investors are becoming available to regular people through AI-powered retail platforms. Imagine having access to the same analytical capabilities that professional fund managers use, but delivered through an app on your phone. Complex options strategies, international diversification, and advanced risk management techniques are being packaged into user-friendly interfaces that anyone can understand and use.

Picture AI agents that negotiate deals, manage risk, and create their own hedge funds without human oversight. Mustafa Suleyman proposed in MIT Technology Review that an AI would need to research products, negotiate contracts, and manage logistics to make a million dollars. What happens when AI systems start launching their own investment vehicles, complete with marketing strategies, regulatory filings, and client acquisition? These systems could theoretically operate entire financial services companies, making decisions about everything from fee structures to investment philosophies. Would you let an AI set up your own hedge fund?

The regulatory landscape is scrambling to keep up with these changes. Governments worldwide are trying to prepare for AI-dominated markets, but the technology is evolving faster than policy frameworks can adapt. Current regulations were designed for human decision-making timelines, not algorithmic systems that execute thousands of trades per second. Regulators face the challenge of maintaining market stability while allowing innovation to continue.

What does this mean for human traders and financial advisors? Their roles are transforming rapidly. Financial advisors might evolve into what we could call “AI prompt engineers,” crafting instructions for AI systems and charging for their expertise in managing these digital agents. The value shifts from knowing which stocks to pick to knowing how to get the best results from AI trading systems. Human expertise still matters, but the way it gets monetized is changing completely.

Expert predictions suggest day trading will be completely dominated by AI within 18 months. Retail investors are expected to have AI trading assistants by 2027, receiving suggestions based on information they might not otherwise access. Investment newsletters may shift to selling winning prompts instead of stock picks. Social networks for AI trading strategies could emerge, where people share and improve their algorithmic approaches collaboratively.

Retail investors show what one expert calls a “devil may care, screw it, let’s go kind of attitude” toward trying new AI-driven strategies. This receptiveness to experimentation could accelerate adoption and innovation in ways that surprise even the experts. The speed of change in this area means many current predictions could quickly become outdated.

The ethical implications deserve serious consideration. When AI systems make financial decisions that affect millions of people, questions about fairness, transparency, and accountability become critical. Who’s responsible when an AI system makes a bad investment decision with someone’s retirement savings?

We’re witnessing the early stages of a fundamental transformation in how money moves through global markets. The question isn’t whether AI will change investing—it’s how dramatically it will reshape the entire landscape.

Conclusion

These systems now manage real portfolios with real consequences for everyday investors. AI agents aren’t just competing with Wall Street anymore—they’re completely reshaping what it means to invest. The evidence is clear: these systems can outperform human professionals, but they can also glitch at machine speed, as we’ve seen with trading errors and herding behaviors that create market instability.

AI offers ordinary investors access to sophisticated strategies that were once exclusive to institutions. But it also introduces new vulnerabilities that didn’t exist before. As AIs that once only churned out prompts now run micro-cap biotech portfolios, how much control are you willing to give up—and when should your judgment step back in?

Let me know in the comments: which experiment surprised you most, or would you trust AI with $100 of your own money?