One surprising fact: EVA Air is expanding Dallas–Fort Worth to Taipei cargo service from three weekly flights to daily, linking more than 450 weekly flights across Asia and strengthening global trade lanes that retailers rely on.

You need to understand how moves like EVA Air’s route growth, Fujitsu and NVIDIA’s full‑stack AI infrastructure, and better digital content distribution shape the economics of automation in retail supply chains. These developments change your cost structure, your automation ROI, and overall supply chain cost efficiency.

This section sets the stage. It shows why retail supply chain automation matters now and how increased air connectivity and high‑performance AI platforms make automation both more feasible and more urgent for U.S. retailers.

Key Takeaways

- Route expansions such as EVA Air’s DFW–TPE increase cargo frequency and resilience, which supports automated inventory flows.

- High‑performance AI infrastructure from Fujitsu and NVIDIA lowers barriers to deploying continuous learning agents for warehouse automation.

- Retail supply chain automation can reduce labor costs while improving throughput and accuracy, improving automation ROI when paired with reliable logistics.

- Accessible digital resources and multi‑format distribution accelerate knowledge transfer for integration and workforce retraining.

- Assess automation projects by combining transport connectivity, AI compute availability, and clear measures of supply chain cost efficiency.

Overview of automation trends in retail supply chains

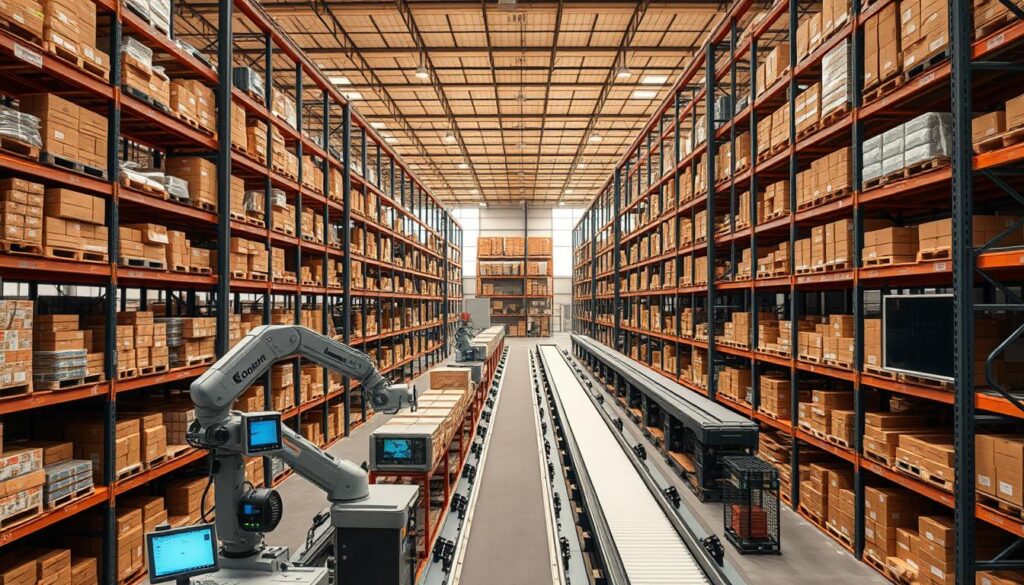

You will see a layered shift in how retail networks run. Automation trends retail logistics now blend robotics, AI, and improved transport links to speed fulfillment and lower errors.

Look back at the history of warehouse automation to trace the change. Early conveyor belts and barcode systems gave way to automated storage and retrieval systems. That history of warehouse automation explains why today’s systems focus on flexibility and integration.

You should note rapid change since 2018. Partnerships between Fujitsu and NVIDIA show how AI in retail supply chains moves from theory to practice. High-performance CPUs and GPUs, connected through NVLink Fusion, power agents that tune inventory and steer robots in real time.

Digital training content and multi-format eBook guides make technical skills easier to access. These resources shorten learning curves and speed deployment of new platforms across distribution centers.

Air route growth affects how you plan networks. EVA Air’s long presence on the DFW–Taipei corridor shows that air cargo influence on retail logistics can be steady and strategic. As passenger routes expand from cargo roots, flight frequency rises and trade lanes become more reliable for time-sensitive goods.

Global cargo expansions shift capacity and timing. You will need to factor increased airlift and new routings into inventory placement, safety stock, and last-mile choices. That air cargo influence on retail logistics changes how you balance speed, cost, and risk.

Below is a compact comparison you can use to assess forces shaping your strategy.

| Driver | What it changes | Practical impact |

|---|---|---|

| Robotics and AMRs | Automates picking and movement | Raises throughput, reduces manual errors |

| AI agent platforms | Optimizes demand, routing, and labor | Improves forecast accuracy and decision speed |

| High-performance compute | Enables real-time models and digital twins | Supports continuous learning and adaptive control |

| Air route and cargo expansions | Increases cross-border capacity and frequency | Shortens lead times for global SKUs |

| Digital content and eLearning | Widens access to technical know-how | Speeds workforce upskilling and tech adoption |

Top picks for "economic automation retail"

Open Amazon search results for this keyword.

As an affiliate, we earn on qualifying purchases.

Cost drivers and upfront investment considerations

You need a clear budget when planning automation. Early-stage estimates should separate one-time capital commitments from recurring operational spend. Drawing parallels to airline route launches, adding capacity requires aircraft, ground handling, and staffing commitments. For retail networks, that translates to automation capital expenditure for hardware and facility works before you see efficiency gains.

Capital expenditure for robotics, conveyors, and automated storage

Start by listing tangible hardware line items. Robotics hardware, conveyors, and ASRS dominate initial spend. You will face the cost of robotics per unit, systems integrator fees, and materials handling infrastructure.

Plan for civil works and power upgrades that support heavy equipment. Those elements push up warehouse redesign costs and can change timelines for go-live.

Software, AI platforms, and integration costs

Software and AI bring distinct budget needs. Licensing, AI model development, cloud or on-prem compute, and high-performance servers are core items. Fujitsu and NVIDIA show that full-stack solutions require CPUs, GPUs, and high-bandwidth interconnects, which add to AI integration costs.

Factor in systems integration, API work, and testing windows. Integration costs often run longer than expected when you need bespoke connectors or industry-specific agents.

Facility redesign and workforce retraining expenses

Physical layout changes are inevitable. You will budget for dock remodeling, rack reconfiguration, safety guarding, and conveyor footprints. These expenses are central to warehouse redesign costs and can include permit and compliance fees.

Training matters for adoption. Multi-format training platforms reduce some instructor time, yet you still face content creation and support costs. Retraining logistics workforce programs should cover both technical skills and safety for human-robot collaboration.

Use a checklist of specific categories to avoid surprises:

- Robotics hardware and maintenance contracts to capture the true cost of robotics

- Conveyor and ASRS procurement and installation

- High-performance servers, GPUs, and networking for AI workloads

- Software licenses, AI model tuning, and data integration

- Facility civil works, electrical upgrades, and safety systems

- Retraining logistics workforce, training content, and user support

Create a phased funding plan that ties expenditure to milestones. That helps you compare upfront automation capital expenditure with projected operating savings and supports better vendor negotiations.

Operational cost savings and efficiency gains

You can gain measurable operational savings automation by combining smarter transport links, digital twins, and robotics. Shorter transit times from airlines such as EVA Air improve inventory flow between North America and Asia, which lowers lead times and supports leaner safety stock. Those logistics improvements pair with in-warehouse automation to deliver faster, more predictable outcomes.

Labor cost reductions and redeployment strategies

When you automate repetitive picking and sorting, labor redeployment becomes a practical strategy. Staff move from routine tasks into supervision, equipment maintenance, and exception handling. Digital training modules and eBooks by vendors like Coursera and LinkedIn Learning speed up upskilling, so you spend less on agency labor and reduce per-order labor cost.

Throughput, accuracy, and inventory turnover improvements

Full-stack solutions from Fujitsu paired with NVIDIA GPUs enable on-the-fly optimization that increases throughput improvement and accuracy. Better robotics and predictive adjustments cut manual handling, lower picking errors, and raise cycle counts per day. Higher inventory turnover follows, which frees working capital and reduces shrink from mismatches.

Case examples of order-fulfillment time reductions

Real projects show order-fulfillment time reductions through combined transport and automation changes. Faster air connectivity trims lead time to stores and distribution centers. Warehouse digital twins and AI agents shorten decision loops on routing and slotting. The net effect is fewer late shipments, lower return rates, and faster customer deliveries.

| Area | Typical Gain | Driver | Business Impact |

|---|---|---|---|

| Labor cost per order | 15–35% reduction | Robotic picking + labor redeployment | Lower OPEX, more skilled roles |

| Picking accuracy | 20–60% improvement | Vision systems + AI validation | Fewer returns, higher customer satisfaction |

| Throughput | 30–70% uplift | AMRs, conveyors, optimized workflows | Handle peak demand with less overtime |

| Order-fulfillment time reductions | 25–50% faster | Transport frequency + warehouse automation | Faster delivery promises, competitive edge |

| Inventory turnover | 10–40% increase | Better forecasting, reduced lead times | Lower carrying costs, improved cash flow |

Impact of AI and full‑stack infrastructure on retail automation

You need infrastructure that turns data into timely actions at scale. Modern retail centers collect streams from sales terminals, warehouse sensors, and wider transport networks like EVA Air’s expanded routes. That increase in regional signals helps AI agents inventory optimization models spot demand shifts fast.

The right compute stack matters when you require real-time inference and tight feedback loops. FUJITSU-MONAKA servers paired with NVIDIA GPUs through NVLink Fusion retail automation deliver the bandwidth and low latency necessary for digital twins, robotics control, and distributed inference at the edge.

AI agents can run continuous experiments against live flows to improve forecasts and replenishment rules. You can deploy agents for local SKU mixes and still sync global trends, which reduces safety stock without raising stockouts.

Role of AI agents in inventory optimization and demand forecasting

AI agents inventory optimization works by blending historical sales, point-of-sale bursts, and transport-level signals into short-term forecasts. You will see faster detection of regional surges and improved allocation across DCs.

Importance of AI computing infrastructure for real-time automation

FUJITSU-MONAKA CPUs, NVIDIA GPUs, and NVLink Fusion retail automation form a full-stack environment that lets you run large models and stream updates to controllers. This setup cuts model latency so pick-and-pack robots and sortation systems act on near-instant forecasts.

How continuous learning systems create sustained productivity gains

Continuous learning AI lets models adapt as demand and routing patterns change. When models retrain on fresh data, you keep accuracy high and reduce manual rule changes.

- Real-time inventory optimization lowers carrying cost and improves fill rates.

- Adaptive replenishment responds to transport disruptions and seasonal swings.

- Self-improving agents reduce human tuning and speed rollout of new SKUs.

Supply chain resilience and risk management benefits

You need systems that react fast when demand spikes or routes change. Supply chain resilience automation lets you trigger rerouting, reassign capacity, and update forecasts in minutes instead of days. That reduces stockouts and shortens recovery time after transport interruptions.

Fujitsu and NVIDIA have shown how full‑stack platforms power digital planning. Digital twins predictive maintenance workflows simulate failures, test alternate paths, and schedule fixes before outages occur. These models cut downtime by revealing weak nodes and by enabling targeted interventions.

You can use automated rerouting triggers to respond to sudden port closures or weather events. Route disruptions cargo connectivity improvements from airlines with dense networks, such as EVA Air’s expanded Dallas–Taipei services, create backup lanes and extra capacity. That breadth lowers dependence on a single corridor.

Training matters when new tools arrive. Digital training platforms accelerate operator adoption so your teams follow resilience playbooks faster. Well-trained staff execute automated decisions, reducing human-induced delays and improving recovery from demand shocks.

Practical benefits include better seasonal readiness, fewer emergency shipments, and more reliable on-shelf availability. By combining supply chain resilience automation with digital twins predictive maintenance and enhanced route disruptions cargo connectivity, you strengthen both daily operations and your ability to weather rare events.

Labor market effects and workforce transition strategies

You will see the labor market shift as automation expands in retail supply chains. New roles will cluster around machine upkeep, model tuning, and systems oversight. This section outlines practical steps for your organization and community to manage that change.

Shifts in required skills

Your team must move from manual picking and sorting toward roles that require AI supervision skills and technical maintenance. Firms such as Fujitsu and NVIDIA are already promoting human-AI co-creation, so your workforce will need competency in model monitoring, robotics troubleshooting, and digital twin operation.

Retraining and talent sourcing

Design retraining logistics programs that combine short technical bootcamps with on-the-job practice. Use multi-format learning—eBooks, web readers, hands-on labs—to lower access barriers. Public-private partnerships can fund scalable programs that teach data science basics, systems engineering, and robotics maintenance.

Policy and community planning

Regions with growing logistics hubs, like Dallas–Fort Worth after EVA Air’s route investment, face a mix of opportunity and displacement. Your local policy choices should include incentives for retraining, targeted hiring credits, and planning to absorb workers into higher-skilled positions. Coordinate with community colleges and employers to align curricula with demand.

Practical workforce transition automation steps

- Audit roles to identify tasks ripe for automation and tasks needing AI supervision skills.

- Launch fast-track retraining logistics cohorts tied to hiring commitments.

- Create apprenticeship pipelines with manufacturers and logistics providers.

- Invest in shared training infrastructure to reduce per-learner costs.

These measures reduce friction for displaced workers and strengthen community resilience. You will support long-term employment by pairing automation projects with clear reskilling pathways that match employer needs and regional growth.

Return on investment models and payback timelines

You need clear models to judge automation ROI retail. Start with a simple cash-flow map that lists initial CAPEX, integration costs, and annual operating savings. Use staged rollouts to spread capital and mirror how airlines scale frequency; staged investments can speed revenue ramp and cut early risk.

Simple ROI calculations for automation projects

Calculate net present value and internal rate of return from year-by-year cash flows. Include hardware, software, facility changes, and training. Subtract annual depreciation for robotics and compute. Divide net gains by total invested capital to get a baseline ROI figure.

Longer-term value from increased sales, reduced shrink, and improved customer satisfaction

Model recurring benefits beyond direct wage savings. Faster fulfillment and fewer errors can lift repeat purchases and lower returns. Use conservative uplift rates for sales and factor lower shrink from better traceability. Continuous-learning AI agents, similar to systems from Fujitsu and NVIDIA, can reduce error rates over time and push the payback timeline automation earlier.

Sensitivity analysis: demand variability and technology depreciation

Run scenario analysis across demand swings, price pressure, and faster obsolescence. Vary throughput, error rates, and depreciation schedules to see how payback moves. A robust sensitivity analysis automation helps you find break-even points and worst-case outcomes.

| Model element | Conservative estimate | Base estimate | Aggressive estimate |

|---|---|---|---|

| Initial CAPEX (robotics + infra) | $4,500,000 | $3,000,000 | $2,000,000 |

| Integration & retraining | $900,000 | $600,000 | $300,000 |

| Annual operating savings | $700,000 | $1,200,000 | $1,800,000 |

| Incremental revenue uplift | $400,000 | $800,000 | $1,400,000 |

| Depreciation period (robotics) | 5 years | 7 years | 10 years |

| Estimated payback timeline automation | 5.5 years | 3.2 years | 1.6 years |

Test models using phased capacity increases. Phased deployment lowers early risk and mirrors route frequency scaling that spreads CAPEX. Add digital distribution of training and documentation to reduce ramp time and raise net present value.

Use sensitivity sweeps that change demand by ±20% and shrink reduction by ±10%. Track how those factors shift automation ROI retail and adjust procurement or depreciation to protect your forecast.

Automation’s effect on inventory strategies and working capital

You can use automation to change how you hold stock and free cash for growth. Improved demand signals from AI agent platforms let you tighten reorder points and reduce excess inventory without raising the risk of stockouts. EVA Air’s improved connectivity shortens transit times for many retailers, giving you the option to rely on faster cross-border replenishment and lower ongoing buffers.

Better forecasting cuts safety buffers. When you apply inventory optimization automation and full‑stack compute, forecasts become more granular and dynamic. That supports safety stock reduction and lowers carrying costs. You will see working capital retail automation free up funds previously tied to slow-moving SKUs.

Lead times matter for reorder points. Automation shortens internal processing, while route improvements shrink transit variance. You can set reorder points that reflect shorter, more predictable lead times. Digital twins and continuous learning help you model what happens when lead time changes, so your ordering remains responsive.

There are trade-offs between hub models. A centralized automation hub offers density and lower per-unit handling costs, but it can increase transit time for some customers. A distributed network speeds delivery and reduces last-mile risk, yet it raises capital needs and duplicates automation investments.

Your choice between centralized vs distributed fulfillment should match service goals and cash constraints. If you prioritize lowest cost per order, centralized setups boost automation economics. If speed and regional availability drive sales, a distributed approach with smaller automation footprints may deliver better customer outcomes.

Training and clear documentation speed adoption of new inventory practices. With accessible procedures and on-the-job learning, teams handle dynamic reorder logic and margin-aware stocking. That makes safety stock reduction sustainable and improves the ROI of working capital retail automation projects.

Technology selection: best-fit automation for retail operations

Picking the right mix of systems shapes your cost, speed, and flexibility. Start with clear throughput targets, latency limits, and space constraints. Compare solutions against those metrics before you sign contracts or redesign floors.

AMR vs conveyors is a core trade-off. Conveyors excel for steady, high-volume flows and precise sortation. Autonomous mobile robots give a flexible layout, fast pilot deployment, and incremental scaling. Match the choice to peak hourly picks, SKU density, and changeover frequency.

Off-the-shelf AI vs custom decisions influence performance and time to value. Packaged platforms from companies such as Blue Yonder or Manhattan can speed deployments. Custom full-stack solutions built on Fujitsu CPUs and NVIDIA GPUs with NVLink deliver tight integration for real-time robotics control and continuous learning at scale.

Your vendor strategy should treat suppliers as partners. Evaluate vendor interoperability across middleware, PLCs, and cloud APIs. Ask for documentation on data schemas, latency guarantees, and roadmap alignment with your compute plans.

Use a short checklist to guide procurement:

- Throughput and peak-hour goals.

- Latency needs for motion planning and vision systems.

- Integration effort with WMS and ERP.

- Ability to scale CPUs/GPUs/NVLink for future AI agents.

- Roadmap fit with logistics partners such as airlines or carriers.

Run pilots that mirror real seasonality. Test AMR vs conveyors under load, validate sortation logic, and stress-test AI inference on representative hardware. Measure time-to-stable performance rather than feature checklists.

Document interoperability outcomes. Create integration artifacts that future teams can reuse. Digital educational resources and checklists help procurement and operations compare vendor claims and confirm that vendor interoperability meets your standards.

When you negotiate, balance short-term deployment speed with long-term extensibility. If you choose off-the-shelf AI, ensure the provider supports custom model export and hardware scaling. If you choose custom stacks, build a clear upgrade path that avoids vendor lock-in.

Final selection rests on a matrix of cost, risk, and speed. Use objective benchmarks, pilot data, and supplier engagement to decide which combination of conveyor, AMR, sortation, robotic picking, and AI approach best supports your business goals.

Environmental and sustainability implications of automation

You should weigh the environmental trade-offs when you scale automation in retail. Machines and software cut waste and speed fulfillment. They also shift where emissions occur, from trucks to server rooms or local warehouses. Clear thinking helps you balance gains in efficiency with the carbon footprint of supporting infrastructure.

Energy use of data centers, robotics, and transport versus efficiency gains

You must assess data center energy use alongside robotics power draw and transport fuel. High-performance AI computing from NVIDIA and Fujitsu uses GPUs, CPUs, and NVLink that draw significant power. Smart design and workload optimization can cut idle cycles and lower energy per transaction.

You should measure energy per order and compare it to manual processes. Automated sortation and AMRs reduce last-mile driving, offsetting some upstream energy. Use telemetry and real-time metrics to identify where efficiencies deliver net environmental benefit.

Reducing waste through better demand matching and fewer returns

You can reduce returns demand matching by improving product data, fit guides, and forecasting. Platforms that provide richer visuals and accurate sizing cut mis-picks and customer returns. Fewer returns mean less reverse logistics and lower material waste from packaging and handling.

You should deploy digital twins and AI agents to simulate assortments and promotions. Those tools help you place inventory where demand exists, shrinking safety stock and lowering emissions tied to excess storage. Training and remote support platforms reduce travel while preserving service quality.

How route expansions and modal choices affect carbon footprints

You must consider air route carbon footprint when carriers expand flights or when you add airlift to reach markets faster. EVA Air’s increased flights improve connectivity but raise the carbon cost of rapid replenishment. You should compare modal options and inventory strategies to avoid shifting emissions from transport to warehousing.

You should test hybrid models that trade a small rise in transit time for large drops in airfreight use. Optimized routing, modal shifts to rail or ocean where feasible, and smarter inventory placement can lower total emissions across the network.

Competitive advantage and strategic positioning for retailers

You can use automation to sharpen your market position by cutting fulfillment time and improving consistency. EVA Air’s expansion into Dallas and more North America–Asia flights boost cargo links you can tap to reduce landed cost and speed cross-border deliveries. That access supports faster delivery retail promises while keeping margins healthy.

Fujitsu and NVIDIA full‑stack AI helps you deploy specialized agents and robotics that raise service levels. These tools make premium fulfillment services practical across multiple sites. You get uniform performance whether you serve New York, Dallas, or Los Angeles.

Clear digital content and shared playbooks let teams adopt new automation faster. When your staff learns quickly, you launch customer-facing features sooner. That operational agility turns automation into a durable competitive advantage automation tool.

You can build scale through international logistics partnerships with carriers and integrators that match your tech roadmap. Partnering with airlines, ocean carriers, and third-party logistics firms gives you more control over transit times and inventory flow. Those relationships make it feasible to sell faster delivery retail options without breaking the cost model.

Premium fulfillment services become a revenue generator when you pair automation with selective service tiers. Offer guaranteed same-day or scheduled two-hour windows in dense metros while keeping standard slots for broader regions. This mix lets you capture high-value customers and preserve margins on everyday orders.

| Strategy | What it delivers | Example partners or tech |

|---|---|---|

| Network leverage | Lower landed cost and faster cross-border fulfillment | EVA Air, major ocean carriers, regional freight forwarders |

| AI-enabled operations | Consistent service levels and scalable robotic picking | Fujitsu–NVIDIA full‑stack AI, advanced AMRs |

| Digital learning | Faster deployment and higher first-time accuracy | Internal knowledge platforms, LMS systems |

| Service tiering | New revenue from premium time-window delivery | Premium fulfillment services with SLA options |

| Strategic alliances | Expanded reach and predictable transit | International logistics partnerships, regional 3PLs |

Use these approaches to turn technical change into customer value. When you coordinate network access, AI capabilities, and quality service tiers, you deliver on promises and deepen loyalty. That combination positions your brand for measurable growth.

Regulatory, security, and ethical considerations

When you deploy automation across retail supply chains, you face rules that affect operations and risk. You must reconcile customs processes, trade paperwork, and local safety codes with automated workflows. Cross-border route expansions like EVA Air’s DFW–TPE service increase the volume of international shipments you handle and raise the need to align systems with cross-border logistics regulations.

Design policies that protect customer and inventory information in transit and at rest. Cloud platforms, edge devices, and third-party logistics providers all touch the same records, so you should embed data privacy supply chain controls into vendor contracts and system logs. Use role-based access, encryption, and audit trails to reduce exposure.

Clarify how automated decision systems act on shipment priorities, pricing, and inventory moves. Work with teams from Fujitsu, NVIDIA, or similar vendors to document model provenance and update plans. Strong AI governance retail practices require documented oversight, versioning, and human review for continuous learning models.

Safety matters when humans share space with robots. You must adhere to OSHA guidance plus ISO 10218 and ISO/TS 15066 standards for human-robot safety standards. Train staff on emergency stops, safe zones, and interaction protocols. Keep maintenance plans, test reports, and incident logs current.

Build compliance training into your onboarding and refresher programs. Use short modules that cover customs forms, export controls, cybersecurity, and privacy requirements. Practical exercises help warehouse teams translate policy into safe, auditable behavior.

Audit controls regularly and run table-top exercises for cross-border scenarios. Create checklists that map trade rules to automated steps such as customs declarations, HS codes, and duty calculations. That way your systems remain robust when routes expand and regulatory detail changes.

Protect proprietary algorithms while maintaining transparency for regulators and partners. Balance IP safeguards with explainability so auditors can verify fairness and accuracy. That approach reduces vendor lock-in and supports trust across the supply chain.

Conclusion

You should view automation conclusions retail through a practical lens: transport capacity, compute power, and workforce readiness together determine success. EVA Air’s DFW–TPE route shows how expanded airfreight and higher frequency can smooth inventory flows and make automated fulfillment more reliable. Aligning route strategy with your technology roadmap reduces stockouts and shortens replenishment cycles.

Investments in high-performance compute matter. The Fujitsu–NVIDIA example highlights that GPUs, CPUs, and NVLink enable continuous-learning agents and digital twins that drive real-time decisions. When you budget for automation, include full‑stack AI infrastructure where latency and accuracy affect throughput. This approach turns capital spending into sustained operational gains and better risk management.

People and process complete the equation. Widespread digital learning materials speed retraining and cut soft costs, so plan staged investments that match payback timelines and workforce transition plans. Use governance to protect data and safety, and leverage online training to shorten time-to-value. In sum, this economics of automation summary points to a balanced retail supply chain strategy: sync transport and compute, phase deployments, and invest in skills to secure a competitive edge.